Tips and Advice for the those interested in or involved in the purchase or sale of real estate.

February 13, 2026

Erin

Local Hamilton Market Statistics General Real Estate Advice Real Estate Trends

Hamilton & Burlington Real Estate Market Update – January 2026

The Cornerstone Association of REALTORS® (Cornerstone) has released its January 2026 real estate statistics, showing a market where sales remain softer year-over-year, inventory is higher, and homes are taking longer to sell across the region. In total, 779 home sales were recorded through Cornerstone’s MLS® System in January, down 7.0% month-over-month and 21.9% year-over-year.

New listing activity also returned seasonally after December, with 2,173 new listings added in January (up sharply month-over-month, which is typical for this time of year). Inventory continued to rise, bringing the region to 3 months of supply by month-end—while average days on market reached 54 days, the highest level reported in over a decade.

“As homes stay on the market longer and interest rates stabilize, opportunities for buyers continue to improve,” says Bill Duce, CEO of Cornerstone.

This Hamilton & Burlington real estate market update for January 2026 will highlight:

- Regional trends in sales, new listings, and inventory

- What months of supply and days on market reveal about today’s pace and leverage

- What current conditions mean for buyers and sellers as we move through early 2026

Coming Up: Key Highlights From January’s Market Performance

Next, we’ll break down the combined Hamilton + Burlington regional totals, then move into a Hamilton-only market focus to highlight local trends, property types, and what they mean for your next move.

Hamilton & Burlington Combined Market Snapshot – January 2026

The Hamilton-Burlington market entered 2026 with a steadier month-to-month pattern, even as results remained softer than last year. Sales edged up slightly from December, while new listing activity rebounded sharply in a typical seasonal lift—giving buyers more choice and more time to evaluate options. Inventory levels also continued to trend higher year-over-year, keeping overall conditions closer to balanced and improving negotiating flexibility in many segments.

“The Hamilton-Burlington market is showing signs of stability with a slight month-over-month increase in sales despite the year-over-year decline. With homes staying on the market longer and inventory up by over 23% compared to last year, buyers have more options and potentially more negotiating power. The unchanged monthly HPI indicates we may be reaching a pricing plateau after the significant year-over-year adjustments we've seen.” — Bill Duce, Cornerstone CEO

Hamilton-Burlington Area Highlights

- Sales: 470 (↑ 1.5% month-over-month)

- New listings: 1,203 (↑ 119.9% month-over-month)

- Inventory: ↑ 23.1% year-over-year | Months of supply: 3.2

- MLS® HPI: unchanged month-over-month | ↓ 10.0% year-over-year

- Average days on market: 57 days

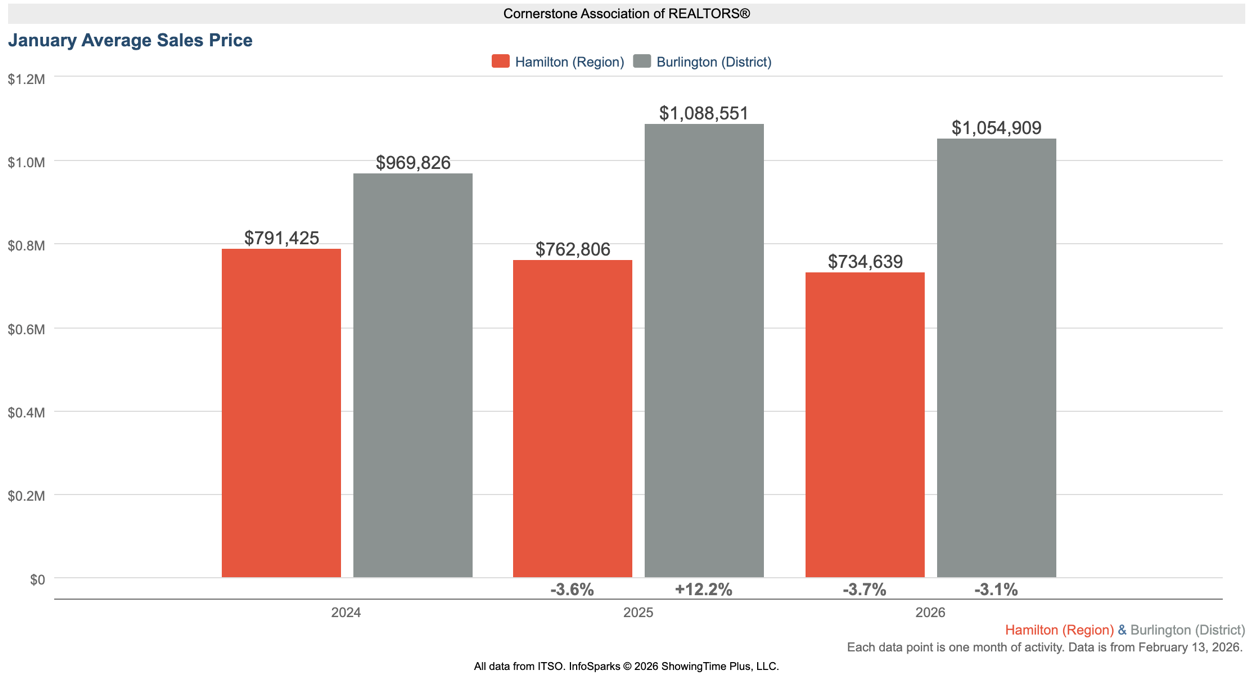

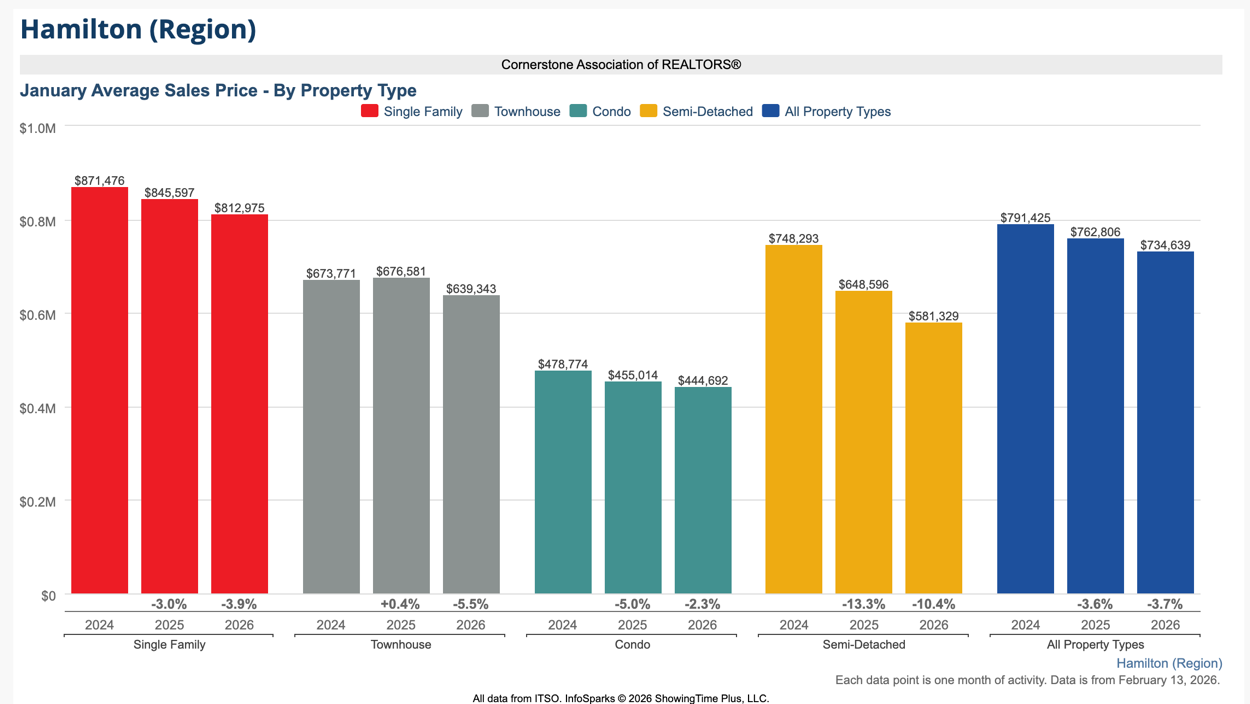

Average Price Snapshot (reported by area)

- Hamilton average price: $734,639 (↓ 3.7% year-over-year)

- Burlington average price: $1,054,909 (↓ 3.1% year-over-year)

What this suggests right now: With inventory up year-over-year and days on market elevated, buyers are generally seeing more breathing room. For sellers, results are still very achievable—especially when pricing is aligned with current conditions and presentation is strong—because the market is rewarding homes that show well and are positioned accurately from day one.

Coming Up: Hamilton Market Focus – January 2026

Next, we’ll move from the regional overview into a Hamilton-only breakdown, including sales, listings, inventory, and pricing—followed by a closer look at performance by property type and key district trends.

Hamilton Residential Real Estate: Price, Sales & Market Conditions

January opened with a quieter year-over-year pace in Hamilton, alongside a more measured national backdrop. The Canadian Real Estate Association (CREA) reported that Canadian home sales declined 2.7% month-over-month in January and were down 4.5% year-over-year, while inventory across Canadian MLS® Systems remained higher than last year—supporting conditions where many buyers have more choice and more time heading toward spring.

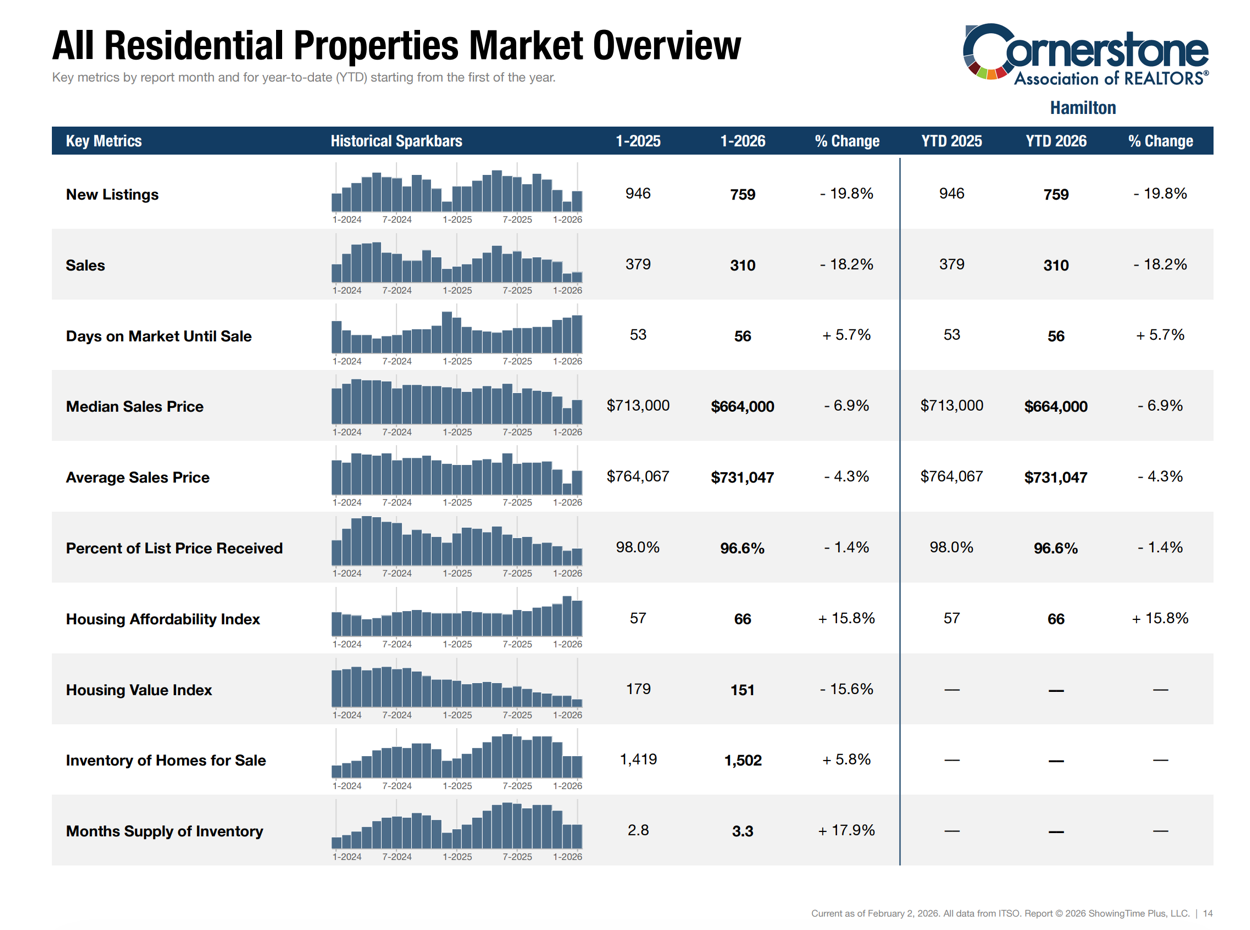

In Hamilton, Cornerstone’s all-residential snapshot shows softer activity and higher supply compared to last January. Hamilton recorded 310 residential sales (↓ 18.2% year-over-year) and 759 new listings (↓ 19.8%). Inventory rose to 1,502 active listings (↑ 5.8%), bringing months of supply to 3.3 (↑ 17.9%). Average days on market increased to 56 days (↑ 5.7%).

Pricing also softened year-over-year:

- Average sale price: $731,047 (↓ 4.3% YoY)

- Median sale price: $664,000 (↓ 6.9% YoY)

- Percent of list price received: 96.6% (down from 98.0%)

What this suggests right now: Hamilton is moving at a more balanced pace than last year, with buyers generally benefiting from more selection and less urgency. For sellers, accurate pricing and strong presentation remain essential, especially as days on market trend higher.

Coming Up: A Closer Look by Housing Segment (Hamilton)

Next, we’ll break down Hamilton’s results by Single Family and Townhouse/Condo segments. This format helps clarify where inventory is building faster, where timelines are lengthening, and how pricing and negotiating conditions can differ depending on the type of home.

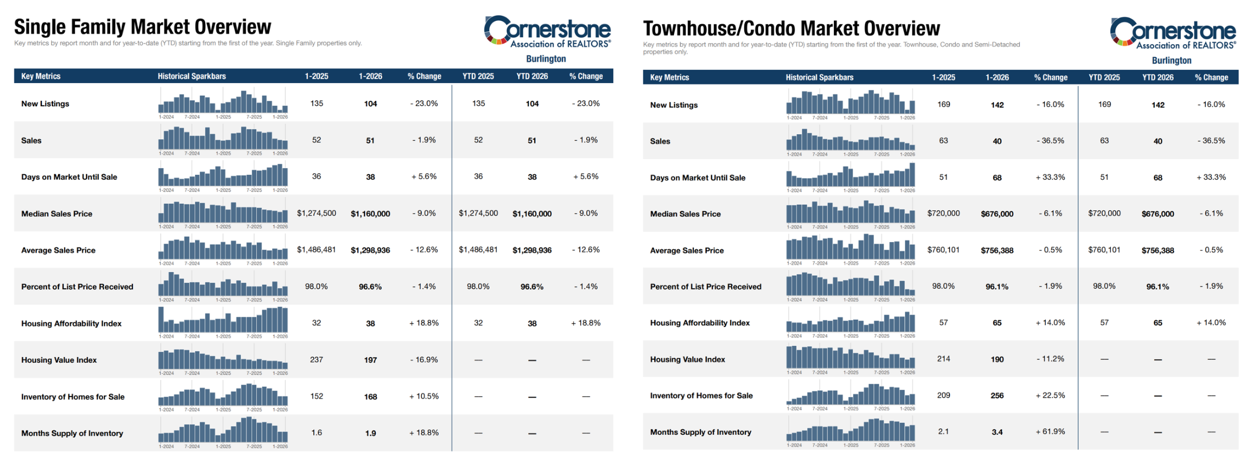

Hamilton Market Breakdown by Housing Segment

To get a clearer picture of what’s driving conditions in Hamilton, it helps to separate the market by housing segment. Single family homes and townhouse/condo properties are responding differently to today’s pricing and supply environment—so below, we’ve summarized the key January indicators for each segment and what they may mean for buyers and sellers.

Single Family Homes (Hamilton)

Single family activity slowed from last January, while supply remained relatively steady.

Key single family indicators (January):

- New listings: 458 (↓ 25.4% YoY)

- Sales: 201 (↓ 18.6% YoY)

- Inventory: 889 (↑ 1.8% YoY)

- Months of supply: 2.8 (↑ 7.7%)

- Days on market: 56 (↑ 5.7%)

- Median price: $705,000 (↓ 10.2%)

- Average price: $808,888 (↓ 4.3%)

- Percent of list price received: 96.4% (↓ 1.8%)

Takeaway: This segment is closer to balanced conditions, but price sensitivity is higher than last year. Homes that are well-positioned and well-presented can still move efficiently, while overpricing can cost time and momentum.

Townhouse/Condo Homes (Hamilton)

The townhouse/condo segment leaned more buyer-friendly in January, with inventory and months of supply rising more sharply.

Key townhouse/condo indicators (January):

- New listings: 301 (↓ 9.3% YoY)

- Sales: 109 (↓ 17.4% YoY)

- Inventory: 613 (↑ 12.3% YoY)

- Months of supply: 4.4 (↑ 41.9%)

- Days on market: 58 (↑ 7.4%)

- Median price: $597,000 (↓ 4.9%)

- Average price: $587,504 (↓ 3.9%)

- Percent of list price received: 96.9% (↓ 0.7%)

Takeaway: With more supply and longer selling timelines, buyers often have more negotiating flexibility in this segment. For sellers, strategy matters—pricing accurately, preparing the home well, and marketing strongly to stand out.

Coming Up: Area-by-Area Breakdown Across Hamilton

Next, we’ll move into an area-by-area breakdown across Hamilton’s key market districts to show where sales activity held firmer, where inventory is building fastest, and how pricing is trending across different parts of the city. This neighbourhood-level view is important because Hamilton doesn’t move as one uniform market—conditions can shift meaningfully from one area to the next depending on housing type, pricing, and buyer demand.

Hamilton District Snapshot: Prices & Sales by Area (January 2026)

To round out Hamilton’s January picture, here’s a district-level snapshot showing how average sale price and sales activity varied across key market areas.

Two standouts this month:

- Hamilton Mountain led the city in sales with 79 transactions, while the average sale price was $696,860 (↓ 3.9% YoY).

- Flamborough posted the highest average sale price at $1,304,375 (↑ 20.3% YoY), with 8 sales—a smaller sample that can contribute to bigger year-over-year swings.

District-level results (January 2026):

- Ancaster Avg: $1,034,500 (↓ 0.8% YoY) | Sales: 33 (0.0% YoY)

- Dundas Avg: $1,207,143 (↑ 35.0% YoY) | Sales: 7 (↓ 58.8% YoY)

- Flamborough Avg: $1,304,375 (↑ 20.3% YoY) | Sales: 8 (↓ 38.5% YoY)

- Glanbrook Avg: $729,882 (↓ 5.3% YoY) | Sales: 17 (↓ 37.0% YoY)

- Hamilton Centre Avg: $506,692 (↓ 6.1% YoY) | Sales: 50 (↑ 8.7% YoY)

- Hamilton East Avg: $563,049 (↑ 3.6% YoY) | Sales: 41 (↑ 5.1% YoY)

- Hamilton Mountain Avg: $696,860 (↓ 3.9% YoY) | Sales: 79 (↓ 13.2% YoY)

- Waterdown Avg: $966,111 (↓ 1.9% YoY) | Sales: 18 (↓ 10.0% YoY)

- Stoney Creek Avg: $802,981 (↓ 1.9% YoY) | Sales: 44 (↓ 36.2% YoY)

- Hamilton West Avg: $585,234 (↓ 14.9% YoY) | Sales: 23 (↓ 8.0% YoY)

What this suggests right now: Pricing and pace are still highly neighbourhood-specific. If you’re making a move in 2026, district-level context matters as much as the city-wide averages.

Coming Up: Market Summary & What It Means for You

Next, we’ll translate January’s numbers into practical takeaways for buyers, sellers, and investors—what they suggest about leverage, pricing, and timing—then share how to connect with Judy Marsales Real Estate Brokerage for neighbourhood-level guidance..

Summary & Expert Insights: Hamilton & Burlington Real Estate Market (January 2026)

January opened with a measured pace across the Hamilton-Burlington market area, with softer year-over-year sales alongside a seasonal rebound in new listings. Cornerstone reported 779 total home sales across its MLS® System (↓ 21.9% YoY) and 2,173 new listings, while inventory remained elevated, keeping conditions more choice-driven for buyers. Days on market reached 54, reinforcing a slower, more balanced pace than last year.

In the Hamilton-Burlington market area, activity was steady month-over-month with 470 sales (↑ 1.5% MoM) and 1,203 new listings (↑ 119.9% MoM). Months of supply was 3.2, and the MLS® HPI was unchanged month-over-month (↓ 10.0% YoY), suggesting pricing may be stabilizing after the larger adjustments of the past year.

Within Hamilton, the market recorded 310 sales (↓ 18.2% YoY) and 759 new listings (↓ 19.8% YoY), with 1,502 active listings and 3.3 months of supply. The average sale price was $731,047 and the median sale price was $664,000. Segment trends also remained split: single family conditions were closer to balanced (2.8 months of supply) while townhouse/condo leaned more buyer-friendly (4.4 months).

“As homes stay on the market longer and interest rates stabilize, opportunities for buyers continue to improve,” says Bill Duce, CEO of Cornerstone.

What This Means for You

- Buyers: More inventory and longer selling timelines mean more opportunity to compare options, negotiate, and include the right protections—especially in higher-supply segments.

- Sellers: Success is still very achievable, but strategy matters. Accurate pricing, strong presentation, and confident marketing are key as buyers become more selective.

- Investors: Higher supply and softer pricing in select segments may create opportunities where negotiation leverage is stronger.

Ready to Buy or Sell? Work With Judy Marsales Real Estate Brokerage

Whether you're planning a purchase, preparing to list, or considering an investment, Judy Marsales Real Estate Brokerage offers the local expertise and trusted guidance you need in today’s market. With 38 years of experience serving our community, our brokerage delivers personalized service and results-driven strategy across Hamilton, Dundas, Ancaster, Burlington, and beyond.

Why Work With Us

- Personalized Guidance for first-time buyers, move-up purchasers, downsizers, and long-time homeowners

- Neighbourhood Expertise grounded in district-by-district insight and current pricing trends

- Up-to-Date Market Knowledge so you can act confidently when the right opportunity appears

Stay Connected

Follow us on Facebook and Instagram for monthly market updates, new listings, open houses, and local community highlights.

Get in Touch

Locke Street South: locke@judymarsales.com | 905-529-3300

Westdale: westdale@judymarsales.com | 905-522-3300

Curious what your home could sell for in today’s market? Use our Home Value Calculator for a quick estimate, or reach out for a more detailed, neighbourhood-specific evaluation. For broader context, you can also review Cornerstone’s January 2026 market statistics.

Make your next move with clarity and confidence — choose Judy Marsales Real Estate Brokerage for trusted local guidance.

January 14, 2026

Erin

Local Hamilton Market Statistics General Real Estate Advice Real Estate Trends

Hamilton Real Estate Market Update – December 2025

The Cornerstone Association of REALTORS® (Cornerstone) has released its December 2025 real estate statistics, showing a year-end market shaped by slower sales and more choice for buyers across Hamilton, Burlington, Haldimand County, and Niagara North. The region closed 2025 with 8,996 total sales, a 12 per cent annual decline, marking the slowest year since 2010 and more than 30 per cent below long-term averages.

This Hamilton real estate market update for December 2025 will highlight:

- Key market shifts that defined the year-end slowdown

- How sales, new listings, and inventory finished 2025 and what that signals for early 2026

- Pricing trends across property types and what they mean for buyers and sellers

According to Cornerstone spokesperson Nicolas von Bredow, fewer new listings entered the market late in the year, while slower sales meant more homes stayed active, giving buyers more options and time to make decisions. He notes 2025 was influenced by broader economic uncertainty, with many buyers remaining cautious due to job-security concerns and higher interest rates.

Looking ahead, von Bredow says the market could see more balanced conditions in 2026 if borrowing costs continue to ease and new government incentives support affordability. He adds that announced tax relief on eligible new homes for first-time buyers could help stimulate demand, while Cornerstone continues to advocate for broader measures to increase impact.

Market conditions in 2025 also weighed on pricing, with an annual decline reported across property types, particularly for row and apartment-style homes. Benchmark prices fell across all areas in the region, with the largest declines in Burlington and smaller declines in Haldimand County.

The statistics in this report are sourced from the ITSO MLS® System and reflect broader market patterns across the region.

Coming Up: Key Highlights From December’s Market Performance

Next, we’ll break down December’s stand-out numbers and what they reveal about year-end conditions in Hamilton covering sales pace, inventory levels, pricing trends, and how today’s market is setting the tone for early 2026.

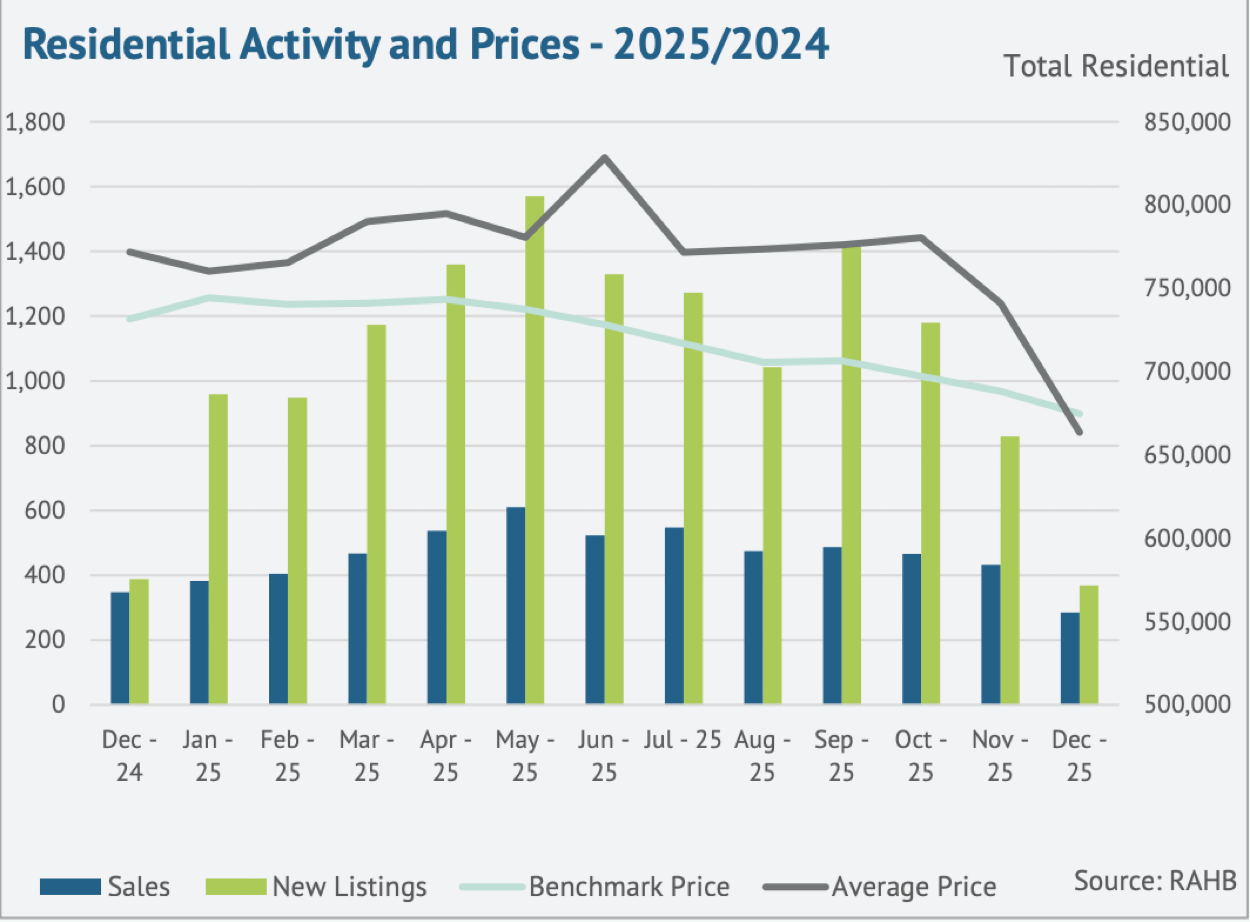

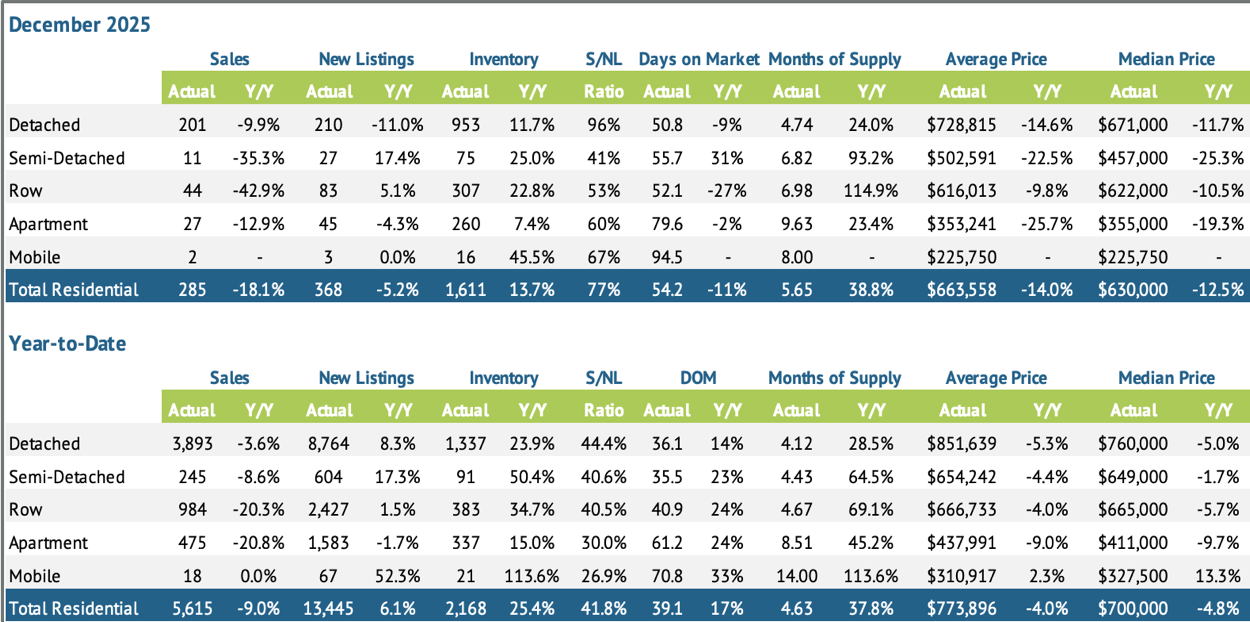

Hamilton Residential Real Estate: Price, Sales & Market Conditions

Hamilton’s residential market ended 2025 on a quieter note. December recorded 285 sales, down 18.1 per cent year-over-year. For the year, Hamilton saw 5,615 sales, a nine per cent decline, marking the lowest annual total since 2010 and more than 30 per cent below typical levels. With demand softer and supply elevated, buyers continued to benefit from more choice and less urgency, while sellers faced a more competitive environment.

Inventory and Listing Activity

New listing activity eased seasonally in December, but inventory remained higher than last year, keeping conditions balanced-to-buyer-leaning.

Key listing and inventory indicators:

- New listings: 368, down 5.2% year-over-year

- Inventory: 1,611 active listings, up 13.7% year-over-year

- Months of supply: 5.7 months, up 38.8% year-over-year

With sales slowing faster than new supply, months of supply have remained above five months since September, reinforcing a market where buyers can take a measured approach.

Pricing Trends and Buyer Conditions

The December residential average price was $663,558, down 14.0% year-over-year. Average days on market (DOM) came in at 54.2 days, down 11.0% year-over-year, indicating that well-priced, well-presented homes can still attract attention.

On an annual basis, the average benchmark price for 2025 was $718,708, about five per cent lower than 2024. Benchmark declines were most pronounced in apartment-style homes (down over eight per cent), while detached, semi-detached, and row homes each declined just under five per cent, a reminder that conditions vary significantly by property type.

Looking Ahead: Property Type Breakdown

Next, we’ll break down December’s results by detached, semi-detached, row, and apartment-style homes to highlight where demand held firmer and where pricing adjustments were most noticeable heading into early 2026.

Hamilton Real Estate: Breakdown by Property Type – December 2025

December showed mixed performance across Hamilton’s major property types. Detached homes remained the most active segment, while row and semi-detached properties recorded the sharpest sales slowdowns. Across the board, elevated inventory and softer demand continued to influence pricing, keeping conditions more favourable for buyers than we’ve seen in recent years.

Below is a closer look at how each property type performed in December and where the most notable shifts occurred.

Detached Homes

- Sales: 201 (↓ 9.9% YoY)

- New Listings: 210 (↓ 11.0%)

- Inventory: 953 (↑ 11.7%)

- Average Price: $728,815 (↓ 14.6%)

- Median Price: $671,000 (↓ 11.7%)

Detached homes continued to lead the market in activity, but sales eased compared to last December. With inventory still rising, buyers have more selection and negotiating room, while sellers are finding that strategic pricing and strong presentation matter more than ever.

Semi-Detached Homes

- Sales: 11 (↓ 35.3% YoY)

- New Listings: 27 (↑ 17.4%)

- Inventory: 75 (↑ 25.0%)

- Average Price: $502,591 (↓ 22.5%)

- Median Price: $457,000 (↓ 25.3%)

Semi-detached homes saw a sharper pullback in sales alongside a rise in both new listings and inventory. This segment remains firmly buyer-leaning, with price sensitivity playing a larger role and fewer purchasers moving quickly.

Row (Townhomes)

- Sales: 44 (↓ 42.9% YoY)

- New Listings: 83 (↑ 5.1%)

- Inventory: 307 (↑ 22.8%)

- Average Price: $616,013 (↓ 9.8%)

- Median Price: $622,000 (↓ 10.5%)

Townhomes recorded one of the steepest slowdowns in sales, while supply continued to build. The result is a more competitive landscape for sellers and greater flexibility for buyers—particularly around pricing and terms.

Apartments & Condos

- Sales: 27 (↓ 12.9% YoY)

- New Listings: 45 (↓ 4.3%)

- Inventory: 260 (↑ 7.4%)

- Average Price: $353,241 (↓ 25.7%)

- Median Price: $355,000 (↓ 19.3%)

Apartments and condos continued to face the most pronounced price softness, even with a smaller decline in sales than some other segments. Higher relative supply and affordability-conscious buyers are keeping pressure on this category, making pricing strategy especially important.

Coming Up: Regional Summary – December 2025

Next, we’ll move into a neighbourhood-level breakdown across Hamilton’s key districts (including areas such as Hamilton Mountain, Hamilton West, and Ancaster) to highlight where sales activity held firmer, where pricing adjusted most, and where more balanced conditions may be emerging as we head into early 2026.

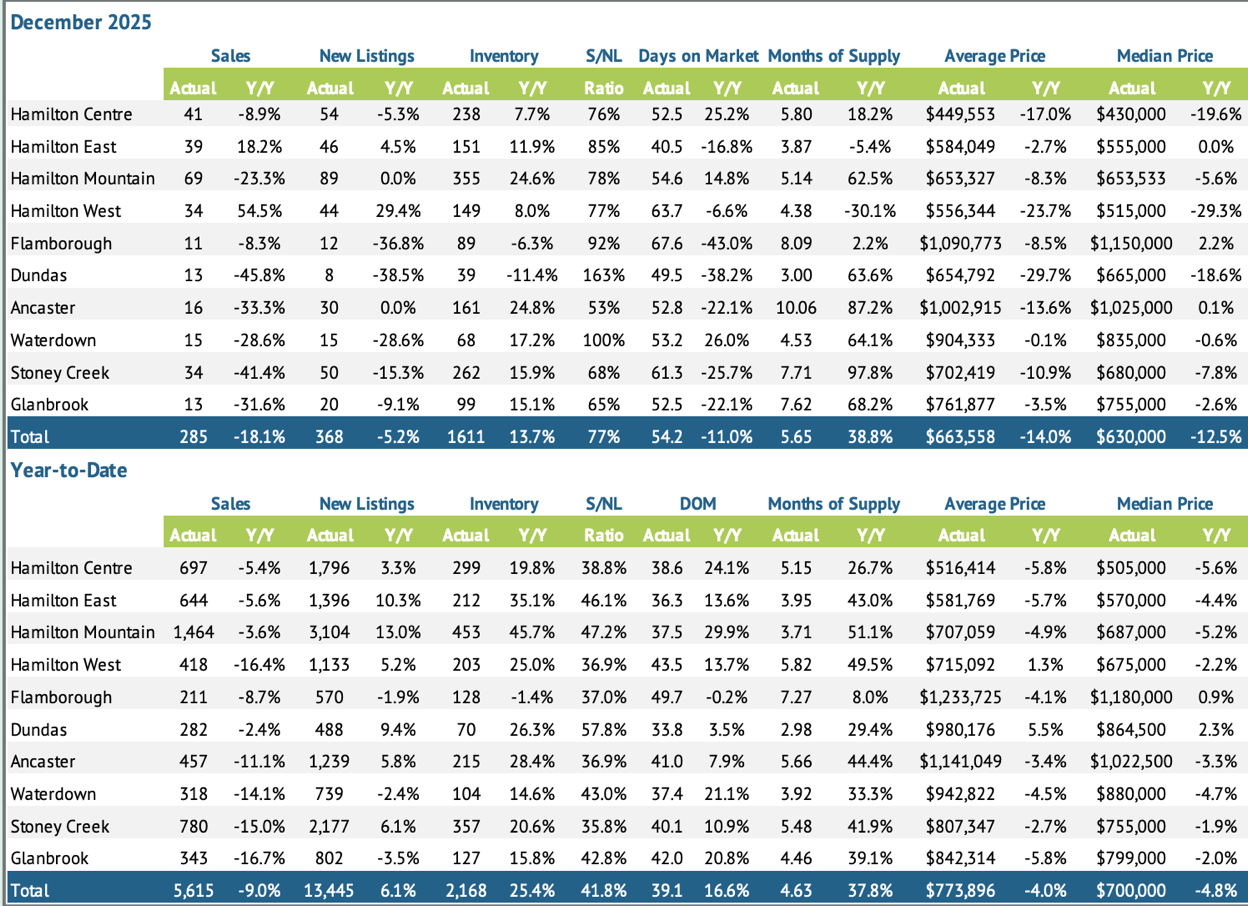

Regional Summary – December 2025

Hamilton’s housing market showed clear variation across districts in December, with a few stand-out trends shaping the month. Hamilton Mountain led the city in sales volume (69 sales), while Hamilton West and Hamilton East were the only two districts to post year-over-year sales gains. At the same time, inventory increased in most areas, and every district recorded a year-over-year decline in average price, reinforcing the broader year-end theme of softer pricing in a higher-supply environment.

Key District Highlights

Hamilton Mountain – Highest Sales Volume (and rising supply)

- Sales: 69 (↓ 23.3% YoY)

- Inventory: 355 (↑ 24.6%) | Months of supply: 5.14 (↑ 62.5%)

- Average price: $653,327 (↓ 8.3%)

Hamilton Mountain remained the city’s busiest district, but higher inventory and rising supply helped keep conditions more measured.

Hamilton West – Strongest sales gain (but softer pricing)

- Sales: 34 (↑ 54.5% YoY)

- New listings: 44 (↑ 29.4%)

- Average price: $556,344 (↓ 23.7%)

Sales improved in Hamilton West, but pricing remained under pressure—suggesting buyers still held meaningful leverage.

Hamilton East – Sales growth with comparatively tighter supply

- Sales: 39 (↑ 18.2% YoY)

- Months of supply: 3.87 (↓ 5.4%)

- Average price: $584,049 (↓ 2.7%) | Median price: $555,000 (0.0%)

Hamilton East stood out for steadier pricing and one of the tightest supply positions in the city.

Supply didn’t rise everywhere: Flamborough and Dundas

- Flamborough inventory: 89 (↓ 6.3%) | New listings: 12 (↓ 36.8%)

- Dundas inventory: 39 (↓ 11.4%) | New listings: 8 (↓ 38.5%)

These were the only two districts where inventory fell year-over-year, largely tied to a sharp pullback in new listing activity.

Most buyer-leaning supply: Ancaster

- Months of supply: 10.06 (↑ 87.2%)

- Average price: $1,002,915 (↓ 13.6%)

Ancaster continued to show the most supply-heavy conditions, offering buyers significant choice heading into the new year.

2025 Year-to-Date Snapshot for Hamilton

Looking at the full year, the year-to-date figures capture the bigger story of 2025: sales slowed, new listings increased, and inventory built, creating more balanced conditions overall.

Total Residential (Year-to-Date):

- Sales: 5,615 (↓ 9.0% YoY)

- New listings: 13,445 (↑ 6.1%)

- Inventory: 2,168 (↑ 25.4%) | Months of supply: 4.63 (↑ 37.8%)

- Average price: $773,896 (↓ 4.0%) | Median price: $700,000 (↓ 4.8%)

Overall, these year-to-date results reinforce a market that became more balanced through 2025, with higher supply giving buyers more breathing room. For sellers, the takeaway is clear: pricing strategy and neighbourhood-level insight matter more than ever.

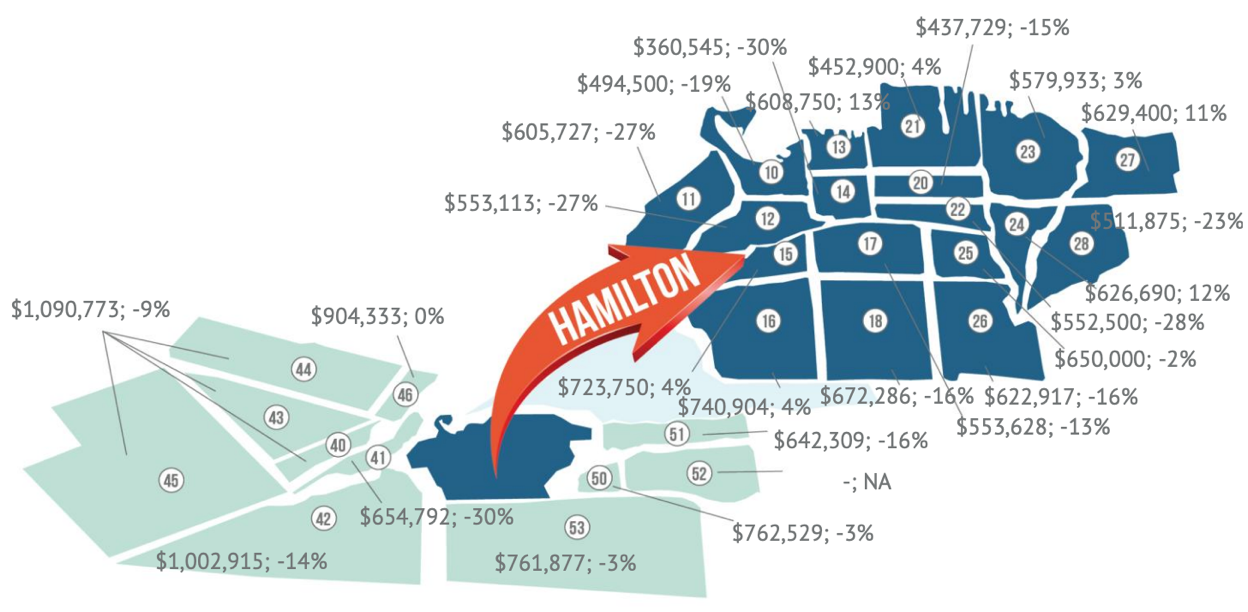

Looking Ahead: Average Residential Price by District

Next, we’ll break down average residential prices by district to show where values held firmer, where year-end softness was most noticeable, and how different neighbourhoods are positioned heading into early 2026.

Average Residential Prices by District – December 2025

Average sale prices continued to show meaningful variation across Hamilton in December, reinforcing a market where neighbourhood-level performance can differ significantly from broader city-wide trends. This month, we’re focusing on Hamilton West, Hamilton East, and Dundas, three areas that highlight just how important micro-market pricing can be as 2025 wraps up.

Hamilton West – Sub-Area Breakdown (Areas 10, 11, 12)

Hamilton West saw consistent year-over-year softening across its key sub-areas, pointing to a more price-sensitive environment.

- Area 10: $494,500 (↓ 19%)

- Area 11: $605,727 (↓ 27%)

- Area 12: $553,113 (↓ 27%)

Standout Insight: With all three pockets trending lower year-over-year—especially Areas 11 and 12—pricing accuracy and strong presentation remain essential to attract qualified buyers.

Hamilton East – Sub-Area Breakdown (Areas 23, 24, 27, 28)

Hamilton East showed a mix of resilience and adjustment, with several sub-areas posting gains even as one recorded a sharper pullback.

- Area 23: $579,933 (↑ 3%)

- Area 24: $626,690 (↑ 12%)

- Area 27: $629,400 (↑ 11%)

- Area 28: $511,875 (↓ 23%)

Standout Insight: Areas 24 and 27 delivered the strongest growth within this group, while Area 28’s decline highlights how outcomes can vary sharply block-to-block depending on property mix, condition, and buyer demand.

Dundas – Sub-Area Snapshot (Area 41)

Dundas saw a notable year-over-year adjustment in December.

- Area 41: $654,792 (↓ 30%)

Standout Insight: This shift underscores the importance of hyper-local comparables in Dundas right now, as pricing can swing meaningfully depending on the specific segment and type of home coming to market.

What This Means for Buyers and Sellers

December’s pricing map reinforces a key takeaway: Hamilton is not moving as one uniform market. For buyers, that creates opportunities to compare sub-areas and negotiate based on very local conditions. For sellers, it highlights the value of district-specific pricing strategy and guidance grounded in neighbourhood-level data.

Next, we’ll summarize the month’s key statistics and share expert insights to help put these trends into context as we head into 2026.

Summary & Expert Insights: Hamilton Real Estate Market

December closed with 285 residential sales in Hamilton, reflecting a typical year-end slowdown alongside softer demand conditions that shaped much of 2025. New listing activity slowed to 368, while active inventory rose to 1,611 homes, keeping conditions balanced-to-buyer-leaning and giving purchasers more options and negotiating room. Hamilton’s average residential sale price was $663,558 and the median price was $630,000, reinforcing the price adjustments seen across many districts as supply remained elevated.

Across the broader Cornerstone region (Hamilton, Burlington, Haldimand County, and Niagara North), 2025 ended with 8,996 total sales, down 12 per cent for the year—marking the slowest annual total since 2010 and more than 30 per cent below long-term averages.

“At the end of 2025, fewer new listings came online, and with more homes staying on the market because of slower sales, buyers had more options,” says Nicolas von Bredow, Cornerstone spokesperson for the Hamilton-Burlington market area. He notes that 2025 was influenced by global uncertainty and economic concerns, with many buyers remaining cautious due to job security and higher interest rates.

What This Means for You

- Buyers: More choice and steadier conditions in many neighbourhoods mean more time to compare options and negotiate confidently.

- Sellers: Strategic pricing and strong presentation remain essential as buyers become more selective.

- Investors: Softer pricing in select segments and districts may create opportunities, particularly where supply is higher.

Moving Forward

As the market continues to adjust, the guidance of an experienced, community-focused REALTOR is essential. Judy Marsales Real Estate Brokerage is here to help you make informed decisions—whether you’re buying, selling, or planning your next move.

Ready to Buy or Sell in Hamilton? Work With a Local Expert Brokerage

Whether you're preparing to list your home, searching for the right property, or considering an investment, Judy Marsales Real Estate Brokerage offers the local expertise and trusted guidance you need in today’s Hamilton market. With more than 38 years of experience serving our community, our team is committed to personalized service and results-driven strategy.

Why Work With Us

- Personalized Guidance: Support for first-time buyers, move-up purchasers, downsizers, and long-time homeowners.

- Hamilton Neighbourhood Expertise: Insight into pricing trends, inventory levels, and district-by-district market conditions.

- Up-to-Date Listings & Market Knowledge: Stay connected to new opportunities across Hamilton, Ancaster, and Dundas.

Stay Connected

Follow us on Facebook and Instagram for:

- Monthly Hamilton market updates

- New listings and open houses

- Local stories and community insights

Get in Touch

Locke Street South: locke@judymarsales.com | 905-529-3300

Westdale: westdale@judymarsales.com | 905-522-3300

Curious what your home could sell for in today’s market? Use our Home Value Calculator for a quick estimate, or reach out for a more detailed, neighbourhood-specific evaluation. For broader context, you can also review Cornerstone’s December 2025 market statistics.

Make your next move with clarity and confidence — choose Judy Marsales Real Estate Brokerage for trusted Hamilton real estate guidance.

December 11, 2025

Erin

Local Hamilton Market Statistics General Real Estate Advice Real Estate Trends

Hamilton Real Estate Market Update – November 2025

The Cornerstone Association of REALTORS® (Cornerstone) has released its November 2025 real estate statistics, revealing a market continuing to rebalance as winter approaches. A total of 624 homes sold across Hamilton, Burlington, Haldimand County, and Niagara North—reflecting the typical seasonal slowdown and contributing to a 12 per cent year-to-date decline in overall sales activity. While demand has eased, market conditions remain stable, with buyers benefiting from improved selection and more time to make decisions.

This Hamilton real estate market update for November 2025 will highlight:

- Stand-out market shifts that shaped November’s performance.

- How sales, new listings, and inventory levels evolved as winter nears.

- Pricing trends and what they mean for buyers and sellers navigating today’s market.

According to Cornerstone spokesperson Nicolas von Bredow, the region is experiencing a more balanced environment after years of intense competition. “Although sales and new listings are down, this is typical as we enter the winter months. We have inventory that is still higher than long-term trends, creating opportunities for those who have been waiting on the sidelines,” he explains. Homes are also taking longer to sell, giving buyers greater negotiating room and reducing the pressure of bidding-war conditions.

Sellers, meanwhile, continue to adjust their expectations from the peak prices of 2022. Well-priced homes are still attracting interest, but elevated supply remains a defining factor. New listings eased compared to last year, bringing the sales-to-new-listings ratio to 50 per cent. Inventory levels, although down slightly from October, are still higher than last year and 68 per cent above long-term trends, reinforcing balanced conditions across the region.

Year-to-date, the average unadjusted benchmark price sits at $775,464, nearly five per cent lower than 2024. Pricing stability continues to vary by district and property type—making local expertise essential when interpreting today’s market signals.

The statistics in this report are sourced from the ITSO MLS® System and reflect broader market patterns across the region.

Coming Up: Key Highlights From November’s Market Performance

Next, we’ll identify the month’s stand-out metrics and explore the factors shaping buyer and seller behaviour heading into the winter season.

Hamilton Residential Real Estate: Price, Sales & Market Conditions

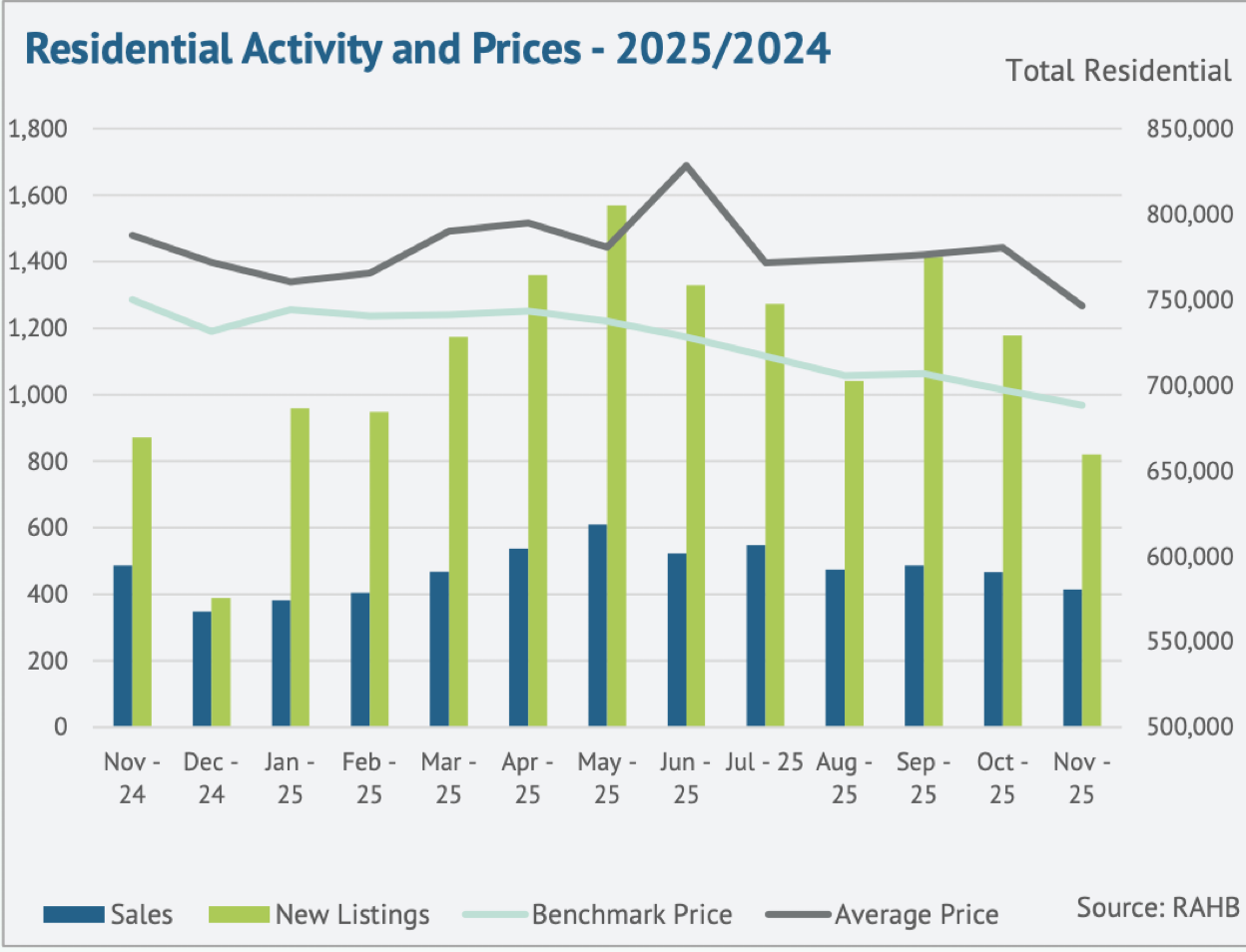

Hamilton’s residential real estate market saw another slowdown in November, with 414 sales, marking a 15 per cent decline year-over-year and one of the lowest November totals in more than a decade. Demand continues to be tempered by affordability challenges, higher borrowing costs, and broader economic uncertainty, contributing to a nine per cent year-to-date decline in overall sales. The average residential price across Hamilton reached $746,377, down 5.2 per cent year-over-year, reflecting a market that is adjusting to elevated inventory and more cautious buyer behaviour.

As seen throughout the fall, quieter conditions are giving buyers more time to make decisions, negotiate, and evaluate options, while sellers continue to recalibrate pricing expectations to align with shifting market trends.

Inventory and Listing Activity

November saw a continued easing in new listings, contributing to a modest pullback in overall supply. Even so, inventory remains elevated compared to last year and well above long-term trends.

Key listing and inventory indicators:

- New listings: 821 units, down 5.7% year-over-year.

- Sales-to-new listings ratio: 50%, representing regional balance and similar buyer-leaning trends within Hamilton.

- Inventory: 2,241 active listings, up 13.4% year-over-year.

- Months of supply: 5.4 months, a 33.3% increase from last year.

While new listing activity has eased, the pullback in demand is the primary factor holding inventory levels high. Oversupply remains most noticeable in higher-density segments such as apartment-style units, where price adjustments continue to be more substantial.

Market conditions vary across neighbourhoods, with several areas showing steadier absorption, while others are experiencing slower turnover heading into winter.

Pricing Trends and Buyer Conditions

The unadjusted benchmark price for November settled at $688,300, an 8 per cent decline year-over-year and nearly 5 per cent lower year-to-date. Price softness continues across property types, with the largest declines occurring in apartment-style homes. Detached and semi-detached properties remain more resilient but are still adjusting to elevated supply and slower sales activity.

Additional pricing insights:

- Prices declined across all major property types, reflecting reduced competition and increased negotiation room.

- Apartment-style units recorded the most significant annual price drops.

- Days on market increased to 49.8 days (up 23.8% year-over-year), highlighting longer decision timelines and more selective buyer behaviour.

Overall, November’s pricing trends reinforce a market where buyers hold more leverage, while sellers must remain strategic with pricing and presentation to attract qualified purchasers.

Looking Ahead: Property Type Breakdown

This overview sets the stage for a more detailed examination of how detached, semi-detached, townhome, and apartment-style properties performed in November. Understanding these differences will help clarify where opportunities may be emerging for both buyers and sellers as we move through the winter market.

Hamilton Real Estate: Breakdown by Property Type: November 2025

November showed varying performance across Hamilton’s major property types, with detached homes remaining the most active segment and higher-density housing seeing the sharpest slowdowns. Elevated inventory and softer demand continued to influence pricing and buyer conditions across the board.

Below, we take a closer look at how each property type performed and where the most notable shifts occurred this month.

Detached Homes

- Sales: 305 (↓ 1.3% YoY)

- New Listings: 567 (↑ 1.4%)

- Inventory: 1,368 (↑ 12%)

- Average Price: $818,353 (↓ 7.1%)

- Benchmark Price: $769,200 (↓ 8%)

Detached homes remained steady, with sales holding close to last year’s levels. Rising inventory is contributing to ongoing price adjustments, giving buyers more negotiating power and longer decision windows.

Semi-Detached Homes

- Sales: 15 (↓ 34.8% YoY)

- New Listings: 36 (↓ 2.7%)

- Inventory: 102 (↑ 27.5%)

- Average Price: $501,927 (↓ 24.6%)

- Benchmark Price: $681,700 (↓ 7%)

Semi-detached activity slowed sharply, with higher inventory and fewer sales putting clear downward pressure on prices. Buyer conditions remained favourable as demand eased.

Row (Townhomes)

- Sales: 63 (↓ 37.6% YoY)

- New Listings: 138 (↓ 17.4%)

- Inventory: 408 (↑ 21.1%)

- Average Price: $632,903 (↓ 8.9%)

- Benchmark Price: $585,900 (↓ 8%)

Townhomes saw significant declines in both sales and pricing. Elevated supply combined with moderating demand continued to create competitive conditions for sellers.

Apartments & Condos

- Sales: 31 (↓ 41.5% YoY)

- New Listings: 77 (↓ 23.8%)

- Inventory: 338 (↑ 3.7%)

- Average Price: $387,113 (↓ 20.5%)

- Benchmark Price: $393,700 (↓ 12%)

Apartments recorded the steepest pullback, with sales and prices falling more than any other segment. Softer demand and higher relative supply continue to weigh on this category.

Coming Up: Regional Summary – November 2025

Next, we’ll move into a detailed regional breakdown across Hamilton’s key districts for November—Hamilton Mountain, Hamilton West, and Ancaster. This overview will highlight how prices, sales activity, and market conditions are evolving at the neighbourhood level, revealing where demand is holding steady, where softness persists, and where balanced conditions are emerging as we head toward the end of 2025.

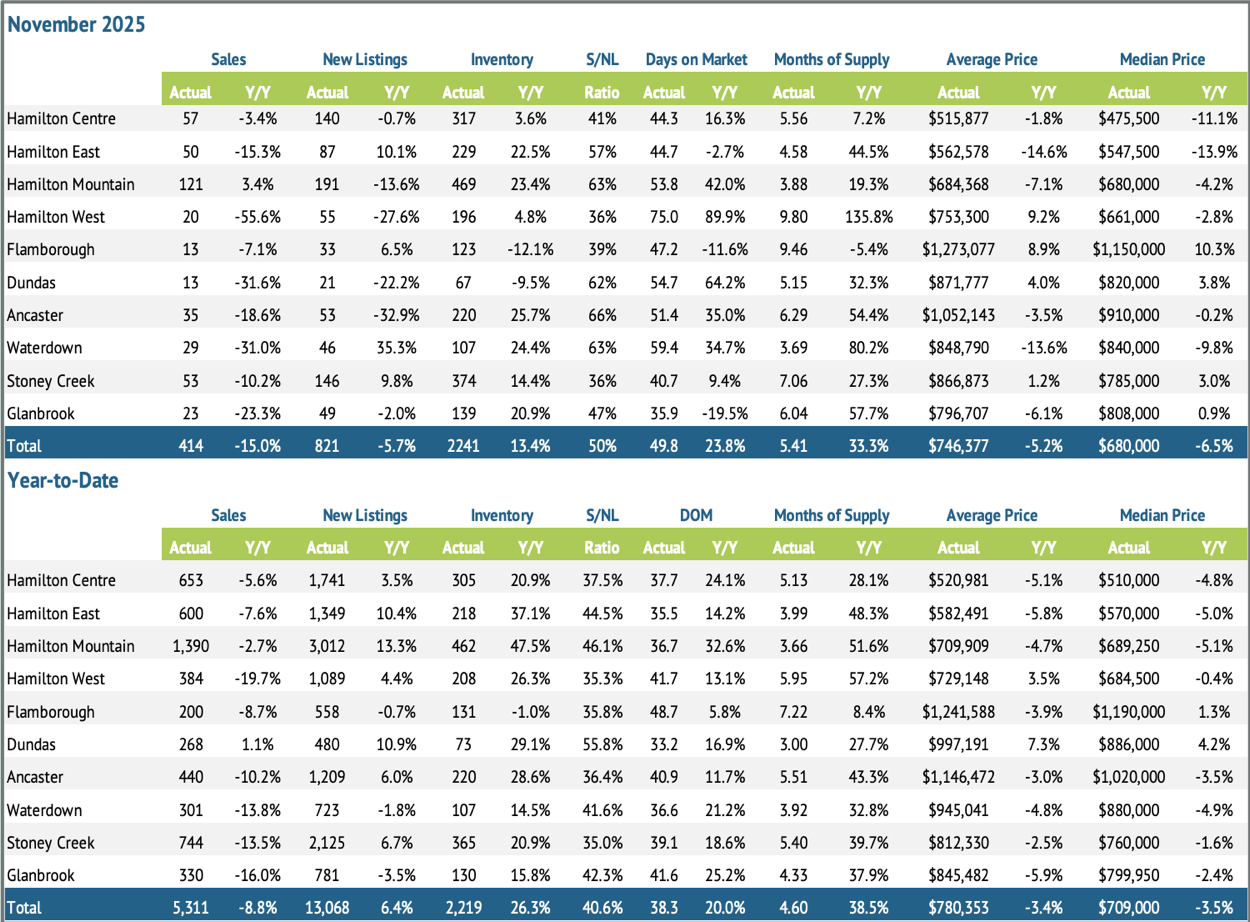

Regional Summary: November 2025

Hamilton’s housing market continued to show notable variation across districts in November, with several stand-out trends shaping overall performance. Hamilton Mountain once again led the city in total sales, reinforcing its position as Hamilton’s highest-volume and most active residential area. At the opposite end of the spectrum, Hamilton West experienced the steepest sales decline, recording the sharpest drop in year-over-year activity among all districts. Meanwhile, Ancaster reported the largest increase in inventory, underscoring the continued buildup of supply in Hamilton’s upper-end suburban markets.

Price trends also varied widely across the city. While many districts saw year-over-year declines, several areas reported notable price growth, including Hamilton West, Flamborough, Dundas, and Stoney Creek—all posting average price increases despite softer sales activity. These gains highlight ongoing demand for specific neighbourhoods and property types, even as broader market conditions remain balanced to buyer-leaning.

Key District Highlights

To better understand how market conditions varied across the city this month, here are the standout district-level shifts that had the greatest impact on Hamilton’s housing landscape. These highlights showcase where demand strengthened, where supply increased, and which neighbourhoods demonstrated unexpected resilience in pricing.

Hamilton Mountain – Highest Sales Volume

- 121 sales (+3.4% YoY), the most of any district in November.

- Hamilton Mountain continues to anchor Hamilton’s residential market, with steady demand and strong turnover contributing to consistently high sales activity.

Hamilton West – Steepest Sales Decline

- 20 sales (↓ 55.6% YoY), the largest year-over-year drop city-wide.

- This significant slowdown reflects shifting demand dynamics in a district that typically sees varied activity tied to student housing, investment properties, and character neighbourhoods.

Ancaster – Largest Inventory Increase

- 220 active listings (+25.7% YoY), the biggest inventory jump of any district.

- The rise in supply is contributing to more balanced conditions in this higher-end market, offering buyers greater choice heading into winter.

Districts with Price Growth

Despite broader market softness, several districts posted year-over-year average price increases:

- Hamilton West: $753,300 (+9.2%)

- Flamborough: $1,273,077 (+8.9%)

- Dundas: $871,777 (+4.0%)

- Stoney Creek: $866,873 (+1.2%)

These price gains highlight the resilience of upper-tier and lifestyle-oriented neighbourhoods, where unique housing stock and strong community appeal continue to support values.

Looking Ahead: Average Residential Price by District

Next, we’ll break down average residential prices across Hamilton Mountain, Hamilton West, Ancaster, and Stoney Creek, offering a closer look at how pricing is shifting within Hamilton’s most active and supply-sensitive areas as we move toward year-end.

Average Residential Prices by District: November 2025

Average sale prices continued to show meaningful variation across Hamilton’s districts in November, reflecting a market where some neighbourhoods are seeing renewed strength while others continue to adjust to softer demand and elevated supply. This month, we’re focusing on Hamilton Mountain, Hamilton West, Stoney Creek, and Ancaster/Flamborough—districts that stood out for their activity levels, pricing shifts, and contrasting sub-area performance.

Understanding these micro-level differences helps buyers and sellers identify emerging opportunities and better navigate the closing months of 2025.

Hamilton Mountain – Sub-Area Breakdown

Hamilton Mountain (Areas 15, 16, 17, 18, 25, 26) remained Hamilton’s strongest district by sales volume. Price movement varied widely across sub-areas, underscoring the diversity of housing stock and buyer demand on the Mountain.

- Area 15: $703,267 (↓ 3%)

- Area 16: $779,548 (↑ 14%)

- Area 17: $604,108 (↓ 18%)

- Area 18: $732,293 (↓ 10%)

- Area 25: $679,143 (↓ 1%)

- Area 26: $593,700 (↓ 15%)

Standout Insight: Area 16 posted the strongest growth on the Mountain with a 14% increase, while Areas 17 and 26 saw notable declines, highlighting how pricing conditions can vary dramatically even within the city’s most active district.

Hamilton West – Sub-Area Breakdown

Hamilton West (Areas 10, 11, 12) recorded one of the most mixed price performances this month, ranging from a steep decline to some of the largest gains city-wide.

- Area 10: $453,750 (↓ 20%)

- Area 11: $785,375 (↑ 7%)

- Area 12: $871,000 (↑ 20%)

Standout Insight: Area 12 recorded a strong 20% increase, one of the highest across the city for November, even as overall sales in Hamilton West declined sharply.

Stoney Creek – Sub-Area Breakdown

Stoney Creek (Areas 50, 51, 52) saw a combination of stability, decline, and an outlier high-value sale affecting average pricing.

- Area 50: $842,157 (↑ 3%)

- Area 51: $740,093 (↓ 18%)

- Area 52: $2,875,000 (N/A)

Standout Insight: Area 50 continues to show modest growth despite elevated supply levels in Stoney Creek, while Area 52 recorded an exceptionally high sale price, increasing the average but not comparable year-over-year due to limited activity.

Ancaster & Flamborough – Upper-End Market Snapshot

These areas continue to define Hamilton’s upper-tier market, each posting average prices well above $1 million.

- Ancaster (Area 42): $1,052,143 (↓ 3%)

- Flamborough (Areas 40, 43–45): $1,273,077 (↑ 9%)

Standout Insight: Flamborough recorded one of the strongest increases across all districts this month, reinforcing persistent demand for rural and estate-style properties.

What This Means for Buyers and Sellers

November’s pricing trends show uneven adjustments across Hamilton. The Mountain remains the most active district, Hamilton West shows pockets of strength, and Ancaster and Flamborough continue to anchor the upper-end market. These variations highlight where buyer opportunities and strategic pricing considerations matter most heading into year-end.

Summary & Expert Insights: Hamilton Real Estate Market

November closed with 624 residential sales across the region, reflecting a typical seasonal slowdown and activity levels still below long-term averages. New listings eased, bringing the sales-to-new listings ratio to 50 per cent, while elevated inventory continued to support balanced-to-buyer-leaning conditions. Hamilton’s benchmark price settled at $688,300, an eight per cent decline year-over-year, with apartment and townhouse segments seeing the most significant adjustments.

“We’re seeing a more balanced market right now, giving buyers more breathing room than in previous years,” says Nicolas von Bredow, Cornerstone spokesperson. “Inventory remains higher than long-term trends, which is creating real opportunities for those who’ve been waiting for the right moment.”

What This Means for You

- Buyers: More choice and stronger negotiating conditions across several districts.

- Sellers: Pricing strategically remains essential as buyers compare more options.

- Investors: Softer prices in select segments may offer new opportunities.

Moving Forward

As the market continues to adjust, the guidance of an experienced, community-focused REALTOR is essential. Judy Marsales Real Estate Brokerage is here to help you make informed decisions—whether you’re buying, selling, or planning your next move.

Ready to Buy or Sell in Hamilton? We’re Here to Help

Whether you're preparing for a move, searching for the right home, or assessing investment opportunities, Judy Marsales Real Estate Brokerage is your trusted partner in Hamilton real estate. With more than 37 years of community-focused experience, our team provides the local insight, market knowledge, and personalized guidance you need in today’s evolving conditions.

Why Work With Us

- Tailored Support: From first-time buyers to long-time homeowners, we’re here for every stage of your journey.

- Local Expertise: Deep understanding of Hamilton’s neighbourhoods, pricing trends, and inventory levels.

- Real-Time Listings: Stay connected to the newest homes, stats, and market activity across Hamilton, Ancaster, and Dundas.

Stay Connected

Follow us on Facebook and Instagram for:

- Monthly market updates

- New listings and open houses

- Local stories and community insights

Get in Touch

Curious about your home’s value? Try our free Home Value Calculator for an instant estimate. Looking for deeper insights? Explore Cornerstone’s full November market report for comprehensive regional trends.

Make your next move with confidence — partner with Judy Marsales Real Estate Brokerage, trusted experts in Hamilton’s real estate community.

September 18, 2025

Erin

Local Hamilton Market Statistics General Real Estate Advice Real Estate Trends

Hamilton Real Estate Market Update – August 2025

The Cornerstone Association of REALTORS® (Cornerstone) has released its August 2025 real estate statistics, reporting a second consecutive month of year-over-year sales growth. With 757 residential sales recorded across the Hamilton-Burlington market area, activity improved compared to August 2024. However, sales levels remain more than 30 per cent below long-term seasonal trends.

This Hamilton real estate market report for August 2025 will cover:

- Hamilton Real Estate Market Update – August 2025: Key takeaways for home buyers, sellers, and investors.

- Sales, Listings, and Benchmark Prices: Detailed housing market trends across Hamilton and surrounding areas.

- Regional Breakdown: Inventory levels and pricing updates from the Cornerstone Real Estate Market Area.

Despite the ongoing gap from historical averages, the rise in year-over-year sales activity marks a positive trend for the local housing market. Cornerstone spokesperson Nicolas von Bredow noted that increased new listings and elevated inventory are creating more balanced conditions and more options for buyers.

A total of 1,601 new listings were added in August, keeping the sales-to-new listings ratio at 47 per cent. Inventory declined slightly month-over-month, following expected seasonal patterns, but remained nearly 15 per cent higher than last year and marked the highest August inventory since 2011.

The unadjusted benchmark price for the region dropped to $754,000, lower than July and down 10 per cent compared to August 2024. Home prices have generally been trending downward since the second half of 2024, offering affordability advantages for buyers entering the market.

Coming Up: A Detailed Look at Hamilton’s Housing Market

In the next section, we’ll take a closer look at the City of Hamilton’s housing performance, with residential sales, benchmark prices, and sub-area breakdowns by property type and district.

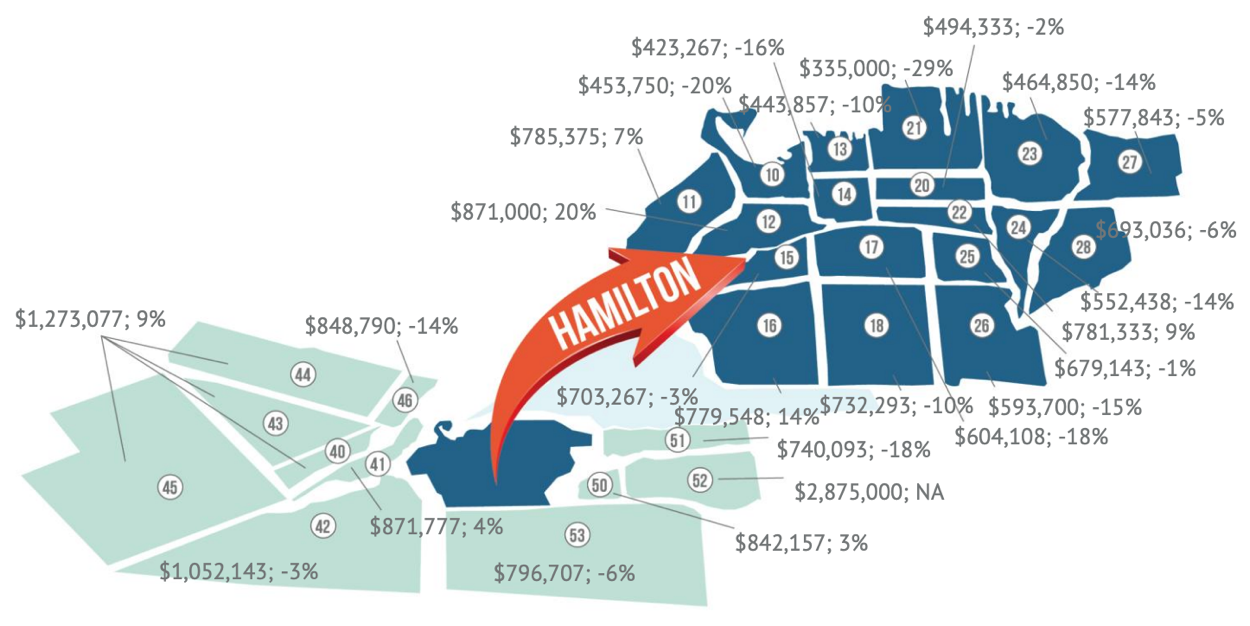

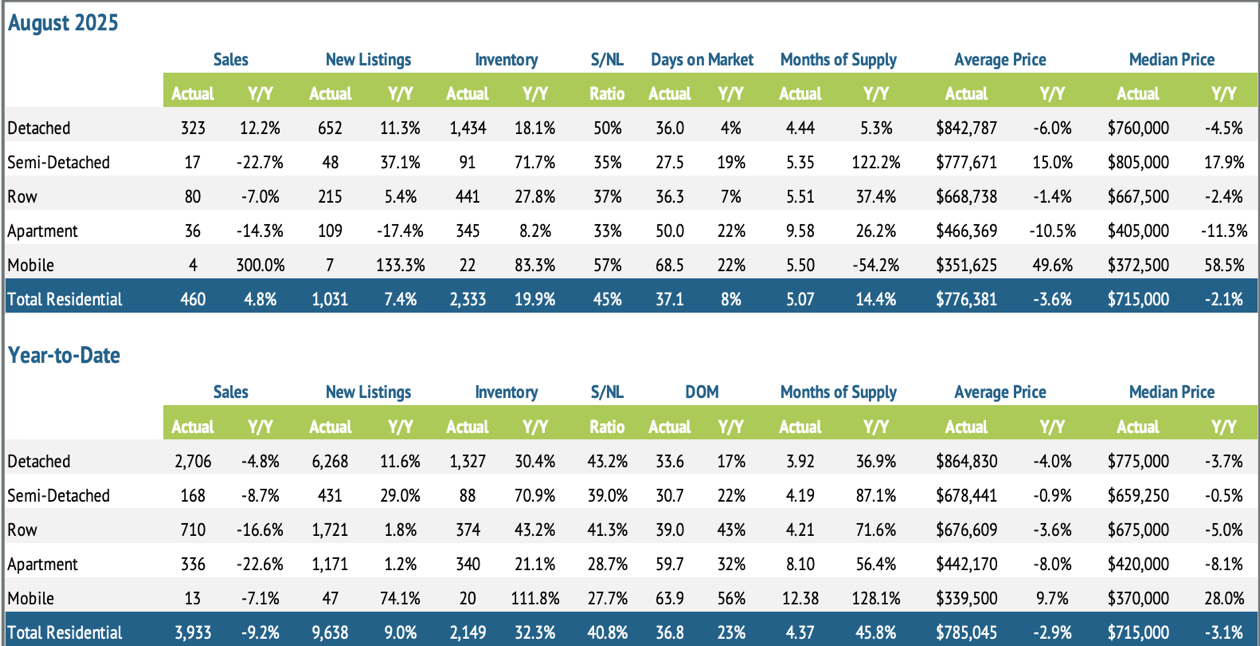

Hamilton Residential Real Estate – Price, Sales & Market Conditions

In August 2025, Hamilton’s residential real estate market reported 460 sales, a year-over-year improvement, but still more than 30 per cent below historical norms for this time of year. While the uptick in activity is encouraging, total year-to-date sales remain nine per cent lower than last year, highlighting the lasting effects of affordability challenges and buyer caution.

Sales improvements were recorded across several property types, but ongoing buyer’s market conditions continue to weigh on overall price growth and pace. Detached and semi-detached homes have experienced moderate declines, while apartment-style units have seen the steepest price adjustments over the past year.

Inventory and Listing Activity

Hamilton saw 1,031 new residential listings in August, a decline from July but still above 2024 levels. This slight shift helped raise the sales-to-new listings ratio to 45 per cent, up from the spring’s sub-40 per cent range, suggesting a slow trend toward more balanced market conditions.

There were 2,333 active listings across Hamilton at month’s end, a 19.9 per cent increase compared to last year. With elevated inventory levels, months of supply sat at 5.1, up 14.4 per cent year-over-year, offering buyers more options and placing downward pressure on prices.

Hamilton East reported the highest months-of-supply across the city at over six months, while Hamilton Mountain saw the lowest at four months, pointing to localized shifts in buyer demand and inventory.

Pricing Trends and Buyer Conditions

The average residential sale price in Hamilton in August was $776,381, a 3.6 per cent decrease compared to August 2024. The benchmark price for the region declined to $703,800, representing a 9 per cent year-over-year drop. These pricing trends reflect a market still navigating affordability concerns and rising supply.

Apartment-style properties posted the largest annual price decline at over 9 per cent, while semi-detached homes saw more moderate dips of around 5 per cent. Conditions remain favourable for well-prepared buyers who are ready to act strategically in a competitive, price-conscious environment.

The average days on market (DOM) in Hamilton was 37.1 in August, up 7.6 per cent from last year, indicating homes are taking longer to sell — a further sign of buyer-driven conditions.

Looking Ahead: Property Type Breakdown

This concludes our overview of Hamilton’s residential market performance for August 2025. In the next section, we’ll break down activity by property type, including detached, semi-detached, townhomes, and apartment-style homes, to offer a clearer view of where opportunities may lie for buyers and sellers alike.

Breakdown by Property Type – Hamilton August 2025

The Hamilton real estate market in August 2025 continued to show varied performance across property types. Detached homes led in year-over-year sales activity, while apartments, townhomes, and semi-detached properties experienced slower sales. Benchmark and average prices fell across all major categories, underscoring ongoing buyer-favoured conditions.

Detached Homes

- Sales: 323 (↑ 12.2% YoY)

- New Listings: 652 (↓ 11.3%)

- Inventory: 1,434 (↑ 18.1%)

- Average Price: $842,787 (↓ 6.0%)

- Benchmark Price: $767,000 (↓ 8%)

Semi-Detached Homes

- Sales: 17 (↓ 22.7%)

- New Listings: 48 (↑ 37.1%)

- Inventory: 91 (↑ 71.7%)

- Average Price: $777,671 (↑ 15.0%)

- Benchmark Price: $705,400 (↓ 5%)

Townhomes (Row Houses)

- Sales: 80 (↓ 7.0%)

- New Listings: 215 (↓ 5.4%)

- Inventory: 441 (↑ 27.8%)

- Average Price: $668,738 (↓ 1.4%)

- Benchmark Price: $605,600 (↓ 8%)

Apartments & Condos

- Sales: 36 (↓ 14.3%)

- New Listings: 109 (↓ 17.4%)

- Inventory: 345 (↑ 8.2%)

- Average Price: $466,369 (↓ 10.5%)

- Benchmark Price: $417,800 (↓ 9%)

Despite a boost in detached home activity, Hamilton's August market showed continued signs of price softening across all property types. Apartment-style units and townhomes experienced some of the steepest annual price declines, while semi-detached homes saw limited sales but higher average prices, likely driven by premium property segments.

Coming Up: Regional Summary

Next, we’ll turn our attention to regional real estate activity across Hamilton’s most active neighbourhoods, with a spotlight on Hamilton Mountain and Stoney Creek. These two areas led the city in both sales volume and new listings in August, with Hamilton Mountain also reporting the highest inventory — providing a clear look at where buyer demand and market supply are most concentrated.

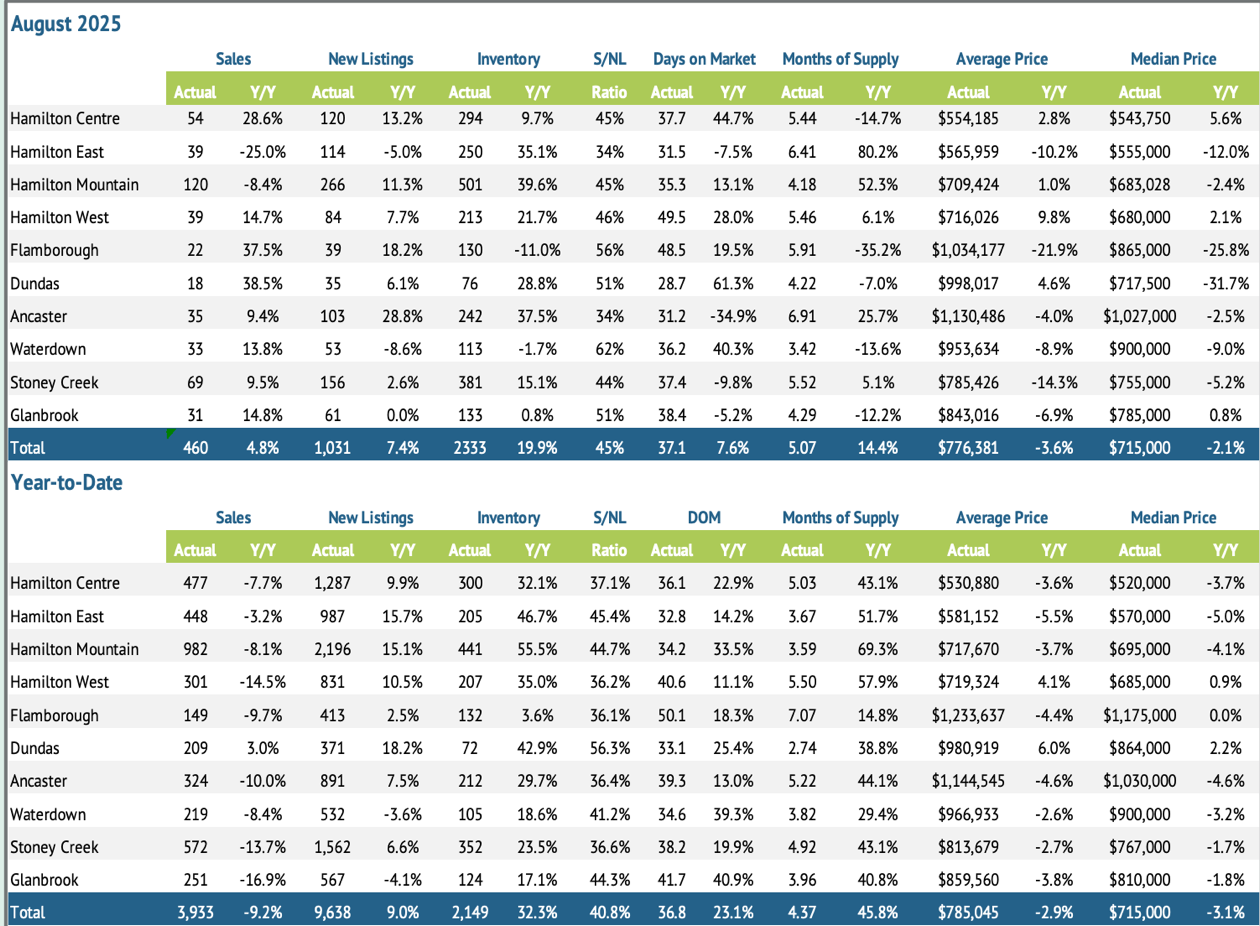

Regional Summary – August 2025

Hamilton’s housing market continued to show signs of stability in August 2025, with Hamilton Mountain and Stoney Creek emerging as the city’s most active neighbourhoods. Both areas reported the highest residential sales and new listings last month, positioning them as important indicators of local buyer demand and supply trends.

Hamilton Mountain, in particular, stood out with the highest inventory city-wide and a double-digit increase in new listings. Although sales in the area declined slightly compared to last year, average prices held firm — suggesting buyer interest remains strong, even in a more competitive environment.

Stoney Creek saw year-over-year gains in both sales and new listings but experienced a significant price correction, creating potential opportunities for buyers looking for detached or move-in-ready homes in a well-connected location.

Meanwhile, Hamilton Centre recorded a sizable jump in sales activity and modest price growth, continuing a trend of increasing demand in the city’s more affordable core neighbourhoods.

Key Metrics by Area – August 2025

Hamilton Mountain

- Sales: 120 (↓ 8.4% YoY)

- New Listings: 266 (↑ 11.3%)

- Inventory: 501 (↑ 39.6%)

- Months of Supply: 4.18 (↑ 52.3%)

- Average Price: $709,424 (↑ 1.0%)

Stoney Creek

- Sales: 69 (↑ 9.5%)

- New Listings: 156 (↑ 2.6%)

- Inventory: 381 (↑ 15.1%)

- Months of Supply: 5.52 (↑ 5.1%)

- Average Price: $785,426 (↓ 14.3%)

Hamilton Centre

- Sales: 54 (↑ 28.6%)

- New Listings: 120 (↑ 13.2%)

- Inventory: 294 (↑ 9.7%)

- Average Price: $554,185 (↑ 2.8%)

Across all regions, inventory levels remain elevated compared to last year, keeping months of supply above long-term norms. This is supporting more balanced market conditions city-wide, with buyers having greater choice and more negotiating room, particularly in neighbourhoods where price adjustments have taken hold.

Coming Up: Average Residential Prices by District

Now that we’ve reviewed regional sales and supply trends, we’ll zoom in further on average residential sale prices by district — with a continued focus on Hamilton Mountain and Stoney Creek. This closer look at property values offers deeper insight into how each neighbourhood is responding to current market dynamics.

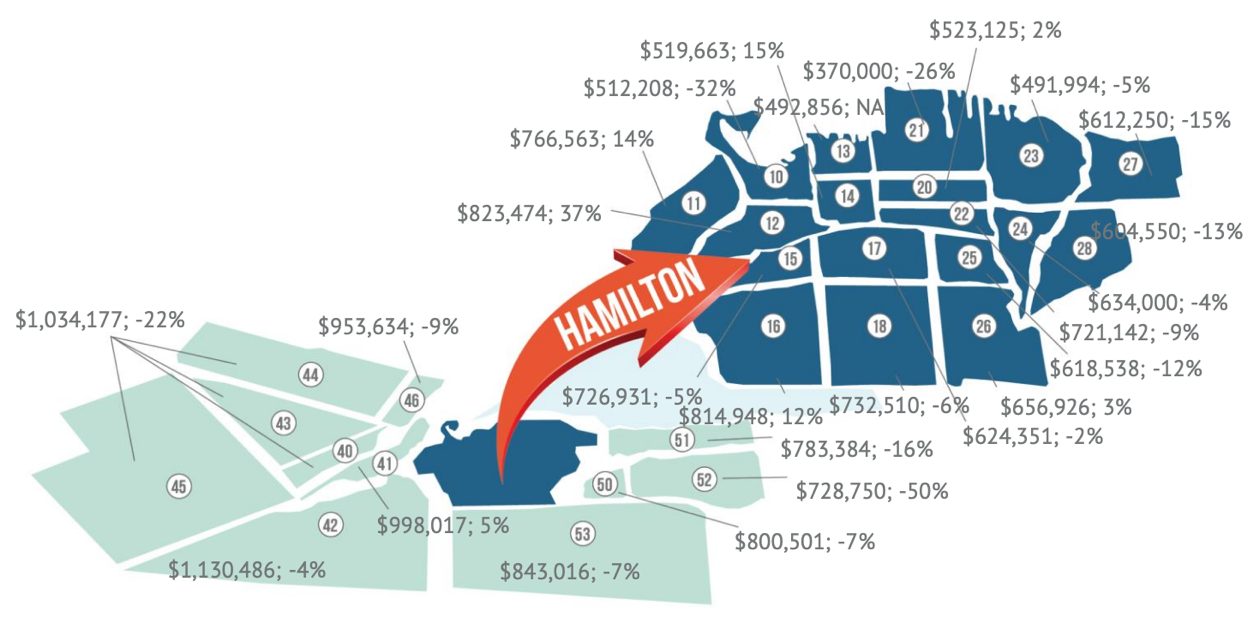

Average Residential Prices by District – August 2025

This section offers a hyperlocal look at average residential sale prices across Hamilton’s neighbourhoods, focusing on areas that saw the most significant market activity and price shifts this month. For August 2025, we’re spotlighting Hamilton Mountain and Stoney Creek, the city’s most active districts based on sales volume, listings, and inventory.

We’ve included the average sale prices for each sub-area within these regions, alongside their year-over-year percentage changes. This breakdown helps buyers and sellers better understand local pricing trends and make informed decisions tailored to specific parts of the city.

Hamilton Mountain Sub-Area Breakdown

Hamilton Mountain is made up of areas 15, 16, 17, 18, 25, and 26 — a consistently high-performing region in terms of both sales and listings. August’s figures show a mix of gains and declines, with price resilience in certain pockets and more pronounced softening in others.

- Area 15 – $726,931 (↓ 5%)

- Area 16 – $814,948 (↑ 12%)

- Area 17 – $624,351 (↓ 2%)

- Area 18 – $732,510 (↓ 6%)

- Area 25 – $618,538 (↓ 12%)

- Area 26 – $656,926 (↑ 3%)

Standout Insight: Area 16 led the Mountain in year-over-year price growth at 12 per cent, while Area 25 saw the steepest decline at 12 per cent. This contrast illustrates how even within one district, pricing dynamics can vary widely — a crucial consideration for buyers and sellers alike.

Stoney Creek Sub-Area Breakdown

Stoney Creek includes areas 50, 51, and 52, and while it maintained strong sales in August, price corrections were substantial — particularly in Area 52.

- Area 50 – $800,501 (↓ 7%)

- Area 51 – $783,384 (↓ 16%)

- Area 52 – $728,750 (↓ 50%)

Standout Insight: Area 52 posted the largest year-over-year price decline in all of Hamilton, down 50 per cent. This sharp correction may signal a key opportunity for buyers, especially those seeking entry into a historically sought-after part of Stoney Creek.

Notable Outlier: Area 12 (Hamilton West)

Although not a focus of this month's breakdown, it's worth noting that Area 12 (Hamilton West) recorded the highest year-over-year price increase in the city at 37 per cent, with an average sale price of $823,474. This surge makes it a district to watch in the coming months.

What This Means for Buyers and Sellers

Hamilton’s sub-area pricing continues to show a tale of two markets — with certain pockets stabilizing or even growing in value, and others seeing accelerated declines. For buyers, this presents opportunities to enter desirable areas like Stoney Creek at more accessible price points. For sellers, pricing strategy will remain key, especially in neighbourhoods where inventory is high and competition is stiff.

Hamilton Real Estate Outlook: Expert Insights & Late Summer Trends

As we wrap up this month’s market analysis, we turn to expert commentary from Nicolas von Bredow, spokesperson for the Hamilton-Burlington region at the Cornerstone Association of REALTORS®. His insights offer valuable perspective on August’s sales, inventory, and pricing trends — and what these developments may signal for buyers and sellers as we approach the close of the summer real estate season.

Summary & Expert Insights – Hamilton Real Estate Market

August 2025 brought 757 residential sales to the Hamilton-Burlington market — the second consecutive month of year-over-year growth, but still over 30 per cent below typical August levels.

New listings rose to 1,601, keeping the sales-to-new listings ratio at 47 per cent, while inventory remained high, up 15 per cent from last year. The benchmark price dropped to $754,000, down 10 per cent year-over-year, with the steepest declines seen in apartments and townhomes.

“The rise in new listings has created a more balanced market,” says Nicolas von Bredow, Cornerstone spokesperson. “With inventory still elevated, buyers are benefiting from lower home prices.”

What This Means for You

Buyers are seeing more choice and better pricing, while sellers should focus on strong pricing strategies to stay competitive.

Thinking about buying or selling in the Hamilton and surrounding area?

The experienced sales representatives at Judy Marsales Real Estate Brokerage are here to help you move forward with confidence.

Ready to Buy or Sell in Hamilton? We’re Here to Help

Whether you’re searching for your dream home, planning your next move, or exploring investment opportunities, Judy Marsales Real Estate Brokerage is your trusted partner in Hamilton real estate.

With 37 years of experience in the local market, we provide the insight, personalized guidance, and strategic expertise you need to navigate today’s evolving real estate landscape, especially as elevated inventory and shifting buyer demand shape market conditions.

Why Work With Us?

- Tailored Support: Whether you're a first-time buyer or a seasoned investor, our sales representatives are here to guide you every step of the way.

- Deep Market Knowledge: We understand Hamilton’s neighbourhood trends, pricing dynamics, and inventory shifts, giving you a clear advantage.

- Real-Time Listings & Data: Access up-to-date market stats and the latest listings in Hamilton, Ancaster, Dundas, and beyond.

Stay Connected With Us

Follow us on Facebook and Instagram for:

- Monthly Market Updates: Including August 2025’s sales performance, price trends, and inventory data.

- New Listings: Be the first to see beautiful homes as they hit the market.

- Local Stories: Discover the people and communities that make Hamilton unique.

Get in Touch With Our Sales Representatives

Have questions or are you ready to get started? Contact one of our three office locations:

- Locke Street South: locke@judymarsales.com | 905-529-3300

- Westdale: westdale@judymarsales.com | 905-522-3300

- Ancaster: ancaster@judymarsales.com | 905-648-6800

Explore More Real Estate Tools

- Home Value Calculator: Curious about your home’s current value? Try our free online tool for a quick estimate.

- Cornerstone’s August 2025 Market Report: Dive deeper into this month’s real estate stats, including property prices, neighbourhood trends, and expert insights.

Make your next move with confidence by partnering with Judy Marsales Real Estate Brokerage — trusted experts in Hamilton real estate, with the local knowledge and experience to help you succeed in today’s market.

April 10, 2025

Erin

Local Hamilton Market Statistics General Real Estate Advice Real Estate Trends

Hamilton Real Estate Market Update – March 2025

The Cornerstone Association of REALTORS® has released its March 2025 housing report, and while ongoing tariffs and trade tensions have influenced the market, there are still positive developments worth noting. Most notably, inventory is up and home prices are trending down — giving buyers more options and more time to make decisions.

This report offers a clear breakdown of current market conditions in Hamilton and surrounding areas. Here’s what we cover:

- Sales, Listings, and Inventory: Data by property type, area, and sub-area.

- Market Trends and Outlook: Insights for buyers, sellers, and investors heading into the spring market.

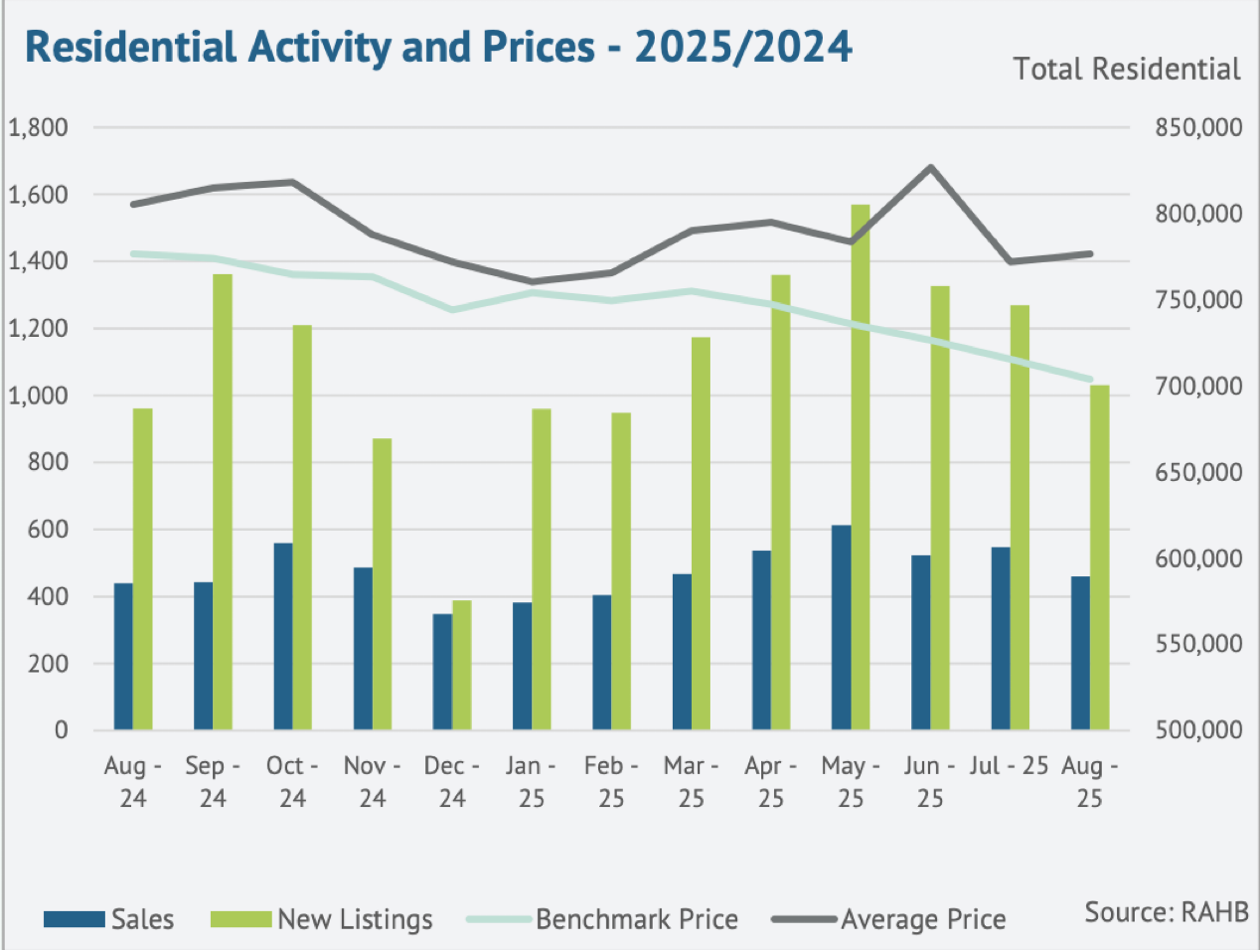

Sales and Inventory Overview – Hamilton and Surrounding Areas

According to Cornerstone’s data, home sales declined across Hamilton, Burlington, Haldimand County, and Niagara North. Only 701 properties were sold in March — the lowest number for that month since 2009. Year-to-date, sales totaled 1,854 units, marking a 27% drop compared to the same period in 2024.

Hamilton, Burlington, and Niagara North all posted double-digit declines in home sales. Haldimand County saw a smaller dip year-over-year. Despite slower activity, new listings increased, which kept the sales-to-new-listings ratio at 40%. This shift improved inventory levels and pushed months of supply to four — higher than usual for March.

Cornerstone noted:

“Rising supply choice combined with easing demand weighed on home prices across all property types. In March, the unadjusted total residential benchmark price was $811,000, dipping one per cent compared to February and five per cent below levels reported last March.”

Looking Ahead: Hamilton Real Estate Trends

In the next section, we’ll dive deeper into the Hamilton housing market, including detailed insights into home prices, sales activity, and inventory by neighbourhood and property type. Stay tuned for a closer look at what’s shaping the real estate landscape in March 2025 and beyond.

Hamilton Residential Real Estate – Sales and Prices

In March 2025, Hamilton recorded 444 residential property sales, a sharp 29.1% decline year-over-year. According to the Cornerstone Association of REALTORS®, this marks the third consecutive month of slower sales compared to the same period in 2024.

The average price of a residential property in Hamilton dropped to $788,968, down 4.8% from last year.

Slower Start to the Year

By the end of Q1 2025, there were 1,218 residential sales in the Hamilton area — a 21% decline year-over-year and the slowest start to the year since 2010.

While sales fell across all sub-areas within the Hamilton real estate market, Hamilton East stood out by maintaining sales levels similar to last year. As Cornerstone noted:

“All areas experienced exceptionally low sales compared to longer-term trends.”

New Listings and Benchmark Prices

New listings saw a modest increase, with 1,111 homes listed in March, up 4.4% year-over-year. The sales-to-new-listings ratio remained low at 40%, boosting inventory to 1,887 units — a 39.5% increase. This pushed the months of supply to 4.25, nearly doubling from last year (+96.6%).

Cornerstone summarized the pricing impact:

“More choice prevented the typical seasonal boost in prices. The unadjusted benchmark price in March was $754,900, over four percent lower than last year. Seasonally adjusted prices have trended down for four consecutive months.”

Hamilton Real Estate Market – Key Metrics (March 2025)

- Home Sales: 444 residential units sold (↓ 29.1% YoY)

- New Listings: 1,111 homes listed (↑ 4.4% YoY)

- Inventory: 1,887 active listings (↑ 39.5%)

- Months of Supply: 4.25 months (↑ 96.6% YoY)

- Average Price: $788,968 (↓ 4.8% YoY)

- Benchmark Price: $754,900 (↓ 4% YoY)

Next Up: Property Type Comparison

This wraps up our review of Hamilton’s residential market activity and home prices for March 2025. We’ve looked at pricing trends, inventory levels, and how sales performance compares to previous years.

In the next section, we’ll break down sales by property type including detached, semi-detached, townhomes, and condos to see how each segment is performing across the Hamilton housing market.

Property Type Breakdown – Hamilton Real Estate Market

In March, benchmark prices across the Hamilton housing market declined across all property types. The steepest drop came from the condo and apartment segment, which saw a significant year-over-year decrease.

According to the Cornerstone Association of REALTORS®, detached homes saw a 3% decline in price compared to March 2024. However, on a seasonally adjusted basis, prices posted a modest gain from February.

Let’s break down the numbers by property type:

Detached Homes

- Sales: 297 (↓ 27% YoY)

- Inventory: 1,156 (↑ 36.7%)

- New Listings: 712 (↑ 9.2%)

- Average Price: $875,327 (↓ 5.8%)

Semi-Detached Homes

- Sales: 19 (↓ 36.7%)

- Inventory: 77 (↑ 79.1%)

- New Listings: 53 (↑ 23.3%)

- Average Price: $691,237 (↓ 0.8%)

Townhomes (Row Houses)

- Sales: 86 (↓ 29.5%)

- Inventory: 315 (↑ 48.6%)

- New Listings: 195 (↓ 10.6%)

- Average Price: $680,260 (↓ 4.4%)

Apartments & Condos

- Sales: 40 (↓ 38.5%)

- Inventory: 325 (↑ 33.2%)

- New Listings: 147 (↑ 0.7%)

- Average Price: $447,720 (↓ 8.6%)

Market Takeaways by Property Type

Across the board, home sales were down, while inventory levels rose significantly. This shift has led to more options for buyers, but continued pricing pressure especially in the condo and townhome markets. Detached homes still command the highest average price, though they too have seen price softening year-over-year.

Comparing year-over-year trends helps us understand market shifts, but monthly changes also matter. For a side-by-side look with last month’s data, check out our February 2025 Hamilton real estate report.

Next Up: Regional Summary

Now that we’ve covered property types, we’ll zoom in on regional real estate trends across Hamilton and surrounding areas. Up next is the Regional Summary, where we break down key stats by city and sub-market.

Regional Summary – Hamilton Real Estate Market

March 2025 brought sales declines across every region in the Hamilton real estate market, with Glanbrook seeing the sharpest drop — down 46.3% with just 29 homes sold.

The average home price also fell in most regions, with the exception of Dundas and Waterdown, which posted modest year-over-year gains of 3.1% and 1.0%, respectively.

Regional Breakdown – Key Market Trends

Dundas

- Sales: 28 (↓ 28.2% YoY)

- New Listings: 55 (↑ 52.8%)

- Inventory: 67 (↑ 81.1%)

- Average Price: $971,486 (↑ 3.1%)

Waterdown

- Sales: 25 (↓ 24.2% YoY)

- New Listings: 56 (↑ 5.7%)

- Inventory: 91 (↑ 68.5%)

- Average Price: $958,756 (↑ 1.0%)

Inventory Growth Across the Board

While most regions saw fewer sales, inventory levels increased significantly throughout Hamilton. This contributed to higher months of supply, giving buyers more leverage and greater choice.

New listing activity varied by area, with some regions experiencing gains and others seeing slight pullbacks. The result is a more balanced and competitive housing market, especially for those actively searching this spring.

Next Up: Hamilton Home Prices by District

In the next section, we’ll take a look at the Average Residential Price Map, which breaks down the Hamilton real estate market by sub-area. This map gives a detailed view of how prices varied across neighbourhoods in March 2025, helping buyers and sellers understand localized trends.

Average Residential Price by District – Hamilton Real Estate Market

The map above highlights the average residential prices across Hamilton’s sub-areas, offering a hyper-local view of how real estate values vary throughout the region. In this report, we’ve placed a special focus on Dundas and Waterdown, and we continue that here to provide more clarity for buyers, investors, and market watchers interested in these specific communities.

Spotlight on Dundas and Waterdown

These two communities correspond to Sub-Areas 41 and 46 within the Hamilton housing market.

Dundas (Sub-Area 41)

- Sales: 28 homes sold in March

- Average Price: $971,486

- Year-over-Year Change: ↑ 3.1%

Dundas saw a moderate boost in home prices compared to March 2024, despite a broader slowdown in sales. The area continues to maintain strong buyer interest thanks to its small-town feel and community amenities.

Waterdown (Sub-Area 46)

- Sales: 25 homes sold in March

- Average Price: $958,756

- Year-over-Year Change: ↑ 1.0%

Waterdown real estate also posted a slight gain in prices year-over-year. While sales volume was down, values held steady — a sign of consistent demand in this popular market pocket.

Across most sub-areas in Hamilton, home sales declined, but these two regions bucked the trend when it came to price resilience.

Next: Final Thoughts and What’s Ahead

You’ve almost reached the end of our Hamilton real estate market update for March 2025. Up next, we’ll hear from Nicolas von Bredow, spokesperson for the Hamilton-Burlington region at the Cornerstone Association of REALTORS®. He’ll share expert insights on the current market climate and what to expect moving forward.

We’ll also show you how to connect with a sales representative from Judy Marsales Real Estate Brokerage if you're ready to take the next step.

Summary & Expert Insight – Hamilton Real Estate Market

The Hamilton real estate market faced continued shifts in March, as global trade tensions — particularly tariffs and counter-tariffs — put pressure on buyer and seller activity. According to the Cornerstone Association of REALTORS®:

“Continued uncertainty about tariffs and retaliatory tariffs is impacting housing activity.”

While sales slowed, price drops opened new opportunities for buyers.

In total, 701 homes were sold across Hamilton, Burlington, Haldimand County, and Niagara North — the lowest March figure since 2009. Cumulatively, the first quarter recorded 1,854 sales, a 27% drop year-over-year.

Expert Perspective from Cornerstone

Nicolas von Bredow, spokesperson for the Hamilton-Burlington region, shared this comment:

“These challenges have slowed sales throughout the first quarter. However, softening prices and higher inventory levels are giving buyers in the market added time and options.”

Looking to Buy? We’re Here to Help

Buying a home doesn’t have to be overwhelming — especially when you’ve got a local expert by your side. With over 37 years of real estate experience in Hamilton and surrounding communities, Judy Marsales Real Estate Brokerage is here to help you navigate the market with confidence.

Whether you’re a first-time buyer or seasoned investor, our sales representatives offer:

- Personalized guidance

- In-depth local knowledge

- Access to the latest listings and market data

Stay Connected With Us

Follow us on Facebook and Instagram for:

- Local real estate updates

- New listings

- Community highlights

We’re here to keep you informed and inspired!

Contact our Offices

For personalized assistance, reach out to one of our three Hamilton locations:

More Tools & Resources

Looking to make your next move in Hamilton’s evolving real estate market? Get expert advice, real-time insights, and personalized support from the brokerage that knows this city best!